As mentioned when accessing your super early on compassionate grounds youre only permitted to access as much as is necessary to pay the relevant expenses. How much can i access.

Investment Plans Should You Prepay Your Home Loan Or Make New

Investment Plans Should You Prepay Your Home Loan Or Make New

can you pay off a rise loan early

can you pay off a rise loan early is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you pay off a rise loan early content depends on the source site. We hope you do not use it for commercial purposes.

If you have a high interest car loan.

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)

Can you pay off a rise loan early. Our experienced and certified credit counselors are available online in person at one of our many locations and via the telephone to help you with your debt management and credit questions. Some people consider it a healthy financial practice to pay off your mortgage early but doing so can sometimes raise your tax bill and expose you to the risk of losing out on more profitable alternatives. The bottom line is that clearing off your loan quick will save you money from interest and lower the overall term of the loan.

Other small sacrifices can go a long way to help pay off your mortgage early. Before doing so make sure your lender doesnt charge a prepayment penalty for paying off the loan early. Here are some of the pros and cons to paying off your student loans early and some tips on how to pay them off.

Lenders need to be sure you have enough income to repay loans and that existing loans dont already eat up too much of your monthly income. For advice on how to pay off a loan early or whether or not paying off a loan early is a good idea contact advantage ccs today. Save for home improvements retirement buy new things or pay off your other debts.

If you have a 60 72 or even 84 month auto loan youll be paying a lot of interest over the life of your loan. See how rise can deliver the cash you need today and help you build a better financial tomorrow. Our website application is fast and we can get you funds as soon as tomorrow plus you can choose your repayment schedule.

The benefits of paying off your 401k loan early. Rise is in your corner with online loans that can be paid back over time. If you have a.

This depends on our assessment of what you can afford your application information and credit history and the loan amounts and terms offered in your state see how it works for more information on the terms in your state. To understand how our rates compare to other options. You also become more attractive as a borrower.

Based on our example mortgage numbers above youll pay your mortgage off a year early saving over 7000 in the process. Just think what you could do with your excess money. For example when you pay off an auto loan you can put the previous monthly payment into savings or pay off other debts.

Put andrew jackson to work for you by adding just 20 to your mortgage payment each month. Read here to learn the pros and cons of paying off your mortgage early. Its important to remember that rise may not be the cheapest credit option and may not be the best option for you.

Paying off the loan early can reduce the total interest you pay. The ato further advises that you cant use this condition of release to access funds to repay rental arrears. The pros paying off your student loan debt early can save you a good chunk of money.

What Is Amortization And How Do You Use It To Pay Off Loans

What Is Amortization And How Do You Use It To Pay Off Loans

How Refinancing Works Pros And Cons Of New Loans

How Refinancing Works Pros And Cons Of New Loans

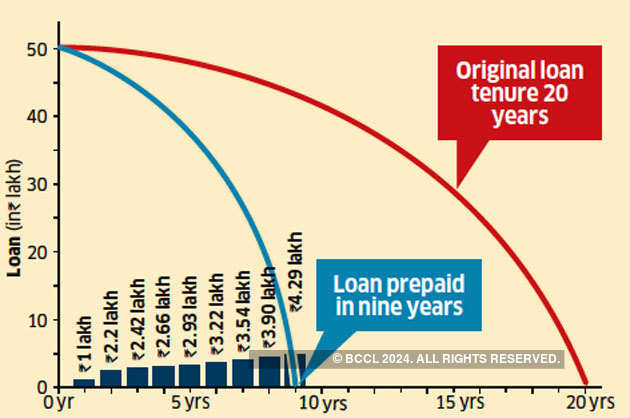

Prepay Home Loan Want To Prepay Your Home Loan Here Is How You

Prepay Home Loan Want To Prepay Your Home Loan Here Is How You

Why Rushing To Pay Off Your Hdb Flat Might Be The Worst Mistake Of

Why Rushing To Pay Off Your Hdb Flat Might Be The Worst Mistake Of

Advantages Of Prepayment And Part Payment Of Personal Loan The

Advantages Of Prepayment And Part Payment Of Personal Loan The

Dbs Live More Bank Less How To Pay Off Your Mortgage Without Stress

Dbs Live More Bank Less How To Pay Off Your Mortgage Without Stress

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Loan To Value Ratio Definition And Calculation

Loan To Value Ratio Definition And Calculation

Rise Credit Review Should You Consider A Loan From Them

Rise Credit Review Should You Consider A Loan From Them

Student Loans Vs Auto Loan Which Should I Pay Off First The

Student Loans Vs Auto Loan Which Should I Pay Off First The