Some mortgages like fha loans allow for the down payment to be a gift from a friend or family member. Each loan type conventional fha va and usda sets maximums on seller paid closing costs.

Conventional Loan Home Buying Guide For 2020

Conventional Loan Home Buying Guide For 2020

can seller pay down payment conventional loan

can seller pay down payment conventional loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can seller pay down payment conventional loan content depends on the source site. We hope you do not use it for commercial purposes.

Can the seller pay for the buyers down payment when an fha loan is being used this is a common question among buyers and seller who are involved with an fha financed real estate transaction.

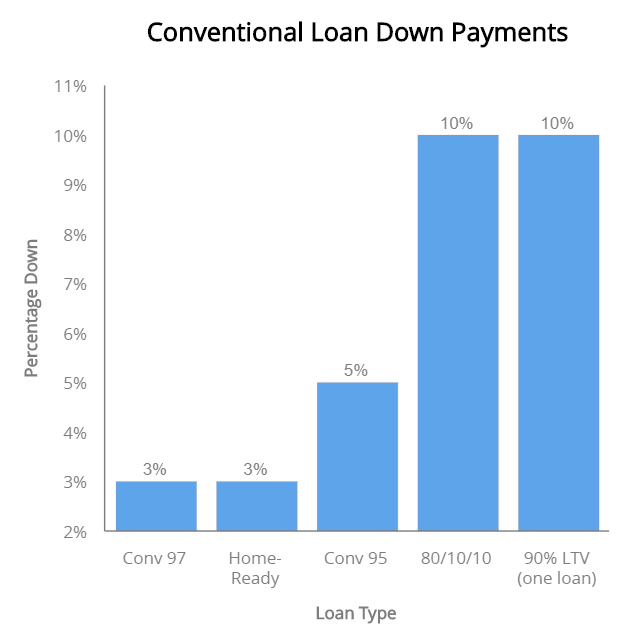

Can seller pay down payment conventional loan. What can the seller pay on a fha loan. Sellers can contribute up to 6 towards the buyers closing costs. Conventional mortgage payment calculator.

Unlike government loan programs conventional loans can be used to purchase a second home or a rental property. Higher mortgage insurance premium. Since the fha loan is so flexible and allows a low down payment it can be a beneficial loan.

If you cant afford the closing costs though explore your options. Fha loans have lower down payment and minimum credit score requirements. While you cant use a loan for a down payment on a house here are some other ways you can come up with your down payment.

Student loans that are in deferment will not be counted against a borrowers dti ratio. If you receive a credit from the seller consider the implications on your loan amount. Conventional seller assistance rules.

A friend or family member can gift the down payment to the borrower. 100 percent of the 35 down payment required for fha loans may be gifted. Conventional 97 allows the seller to pay 3.

You have several options when it comes to covering your fha closing costs. Fha mortgage loans have lower interest rates. The funds from the seller can also be put toward the down payment although a down payment is not required for usda loans.

The exact amount of seller assistance a conventional lender allows depends on the propertys occupancy status the loan program and the buyers down payment. An fha mortgage is a loan insured by the federal housing administration. Va loans for a va loan the seller can pay all of the buyers closing costs and prepaids related to the mortgage including up to two discount points to buy down your interest rate.

Seller paid costs are also known as sales concessions seller credits or seller contributions. Whatever you want to call them new and experienced homebuyers can get into homes faster with help from the seller. Interest rates and down payment requirements are higher when financing a rental home but the conventional loan remains one of the few loan programs available to purchase rental properties.

Previously if a home buyer was looking for a minimal down payment an 35 down payment fha loan was most likely the best option unless heshe meets income limits and is buying in an eligible usda area or heshe is a qualified veteran or active duty military.

How To Ask A Home Seller To Pay A Closing Cost Credit

How To Ask A Home Seller To Pay A Closing Cost Credit

Appreciation Is One Way That The The Difference Between The Market

Appreciation Is One Way That The The Difference Between The Market

Fha Loan In Texas Qualifications And What Are Its Benefits By

Fha Loan In Texas Qualifications And What Are Its Benefits By

Conventional Loan Home Buying Guide For 2020

Conventional Loan Home Buying Guide For 2020

How To Buy A House With 0 Down In 2020 First Time Buyer

How To Buy A House With 0 Down In 2020 First Time Buyer

2015 Wyoming First Time Home Buyer Programs

2015 Wyoming First Time Home Buyer Programs

/what-is-an-interest-only-mortgage-1798407v2-1d8bab55729948ce930d672c239609d7.png) What Is An Interest Only Mortgage

What Is An Interest Only Mortgage

Reblogged On Wordpress Com Down Payment First Time Home Buyers

Reblogged On Wordpress Com Down Payment First Time Home Buyers

5 Types Of Private Mortgage Insurance Pmi