Independent students in their third or fourth year are eligible to receive up to 12500 in stafford loans with a limit of 5500 on subsidized loans. When a parent is denied for a plus loan the dependent child is given extra unsubsidized stafford loans.

Federal Plus Loan Credit Criteria Financial Aid Wayne State

Federal Plus Loan Credit Criteria Financial Aid Wayne State

can you be denied a parent plus loan

can you be denied a parent plus loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you be denied a parent plus loan content depends on the source site. We hope you do not use it for commercial purposes.

If you cant meet the parent plus loan credit score requirements there are other ways to get the money you need.

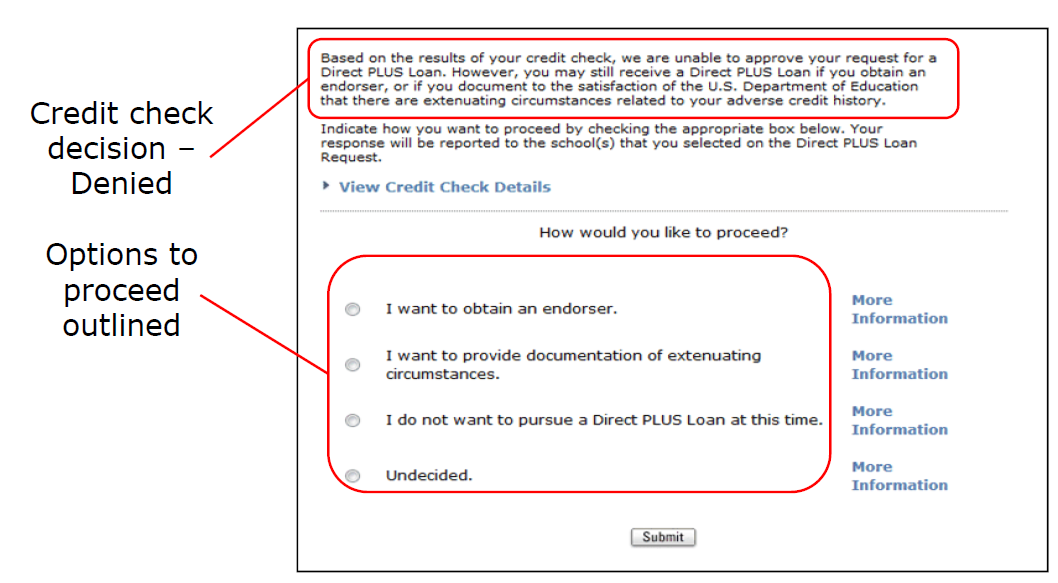

Can you be denied a parent plus loan. If you have been denied a plus loan you still have a couple of options you can pursue to pay for your childs education. An endorser becomes financially obligated to repay the loan if you cannot. Apply with an endorser.

No changes to the person designated to receive the plus loan refund can be made after the loan has been processed. If the parent plus loan was the last funding to be credited to the fee bill the refund will be issued to the parent borrower. The parent plus loan is available to borrowers who do not have an adverse credit history.

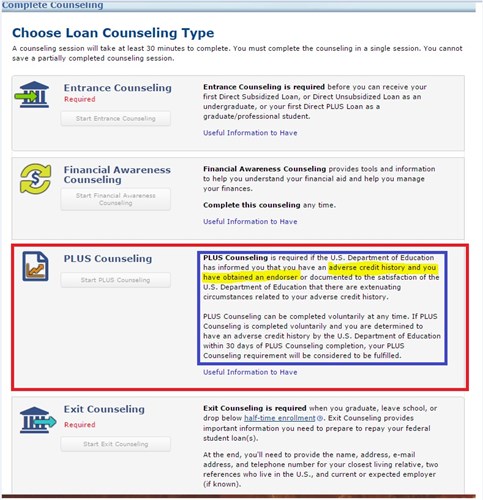

4 alternatives for college parents denied a plus loan parents with an adverse credit history such as recent bankruptcy may be denied a parent plus student loan. Should you need to borrow parent plus loans in the future be aware that previous approval based on extenuating circumstances does not guarantee further approvals according to the parent plus loan forms. 4 alternatives to consider if your application was denied.

These four alternatives can help you find funding. If your application for a federal direct parent plus loan is denied you have three options for borrowing as a parent. If only one parent has bad credit the other parent could apply for the parent plus loan.

All refunds to the parent borrower will be mailed home to the address provided on the plus loan application. If you are denied plus you can have someone other than the student endorse cosign your loan. At the same time because the parent plus loan requires credit approval not all plus offers can turn into secured loans.

The student can be given as much as an independent student at the same grade level. There are several options available to a student whose parent is denied a parent plus loan because of an adverse credit history. How a denied parent plus application can still help your student.

If youve been denied a parent plus loan because of an adverse action from a delinquent account you can fix this by making payments to bring that account current. Options following a parent plus denial an offer of a federal direct parent plus loan on the uc award offer is based on eligibility toward borrowing. Get an endorser who can qualify for a parent plus loan.

Once you do that you can either re apply for the parent plus loan or explain it as an extenuating circumstance.

Federal Parent Plus Loans Financial Aid Wayne State University

Federal Parent Plus Loans Financial Aid Wayne State University

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

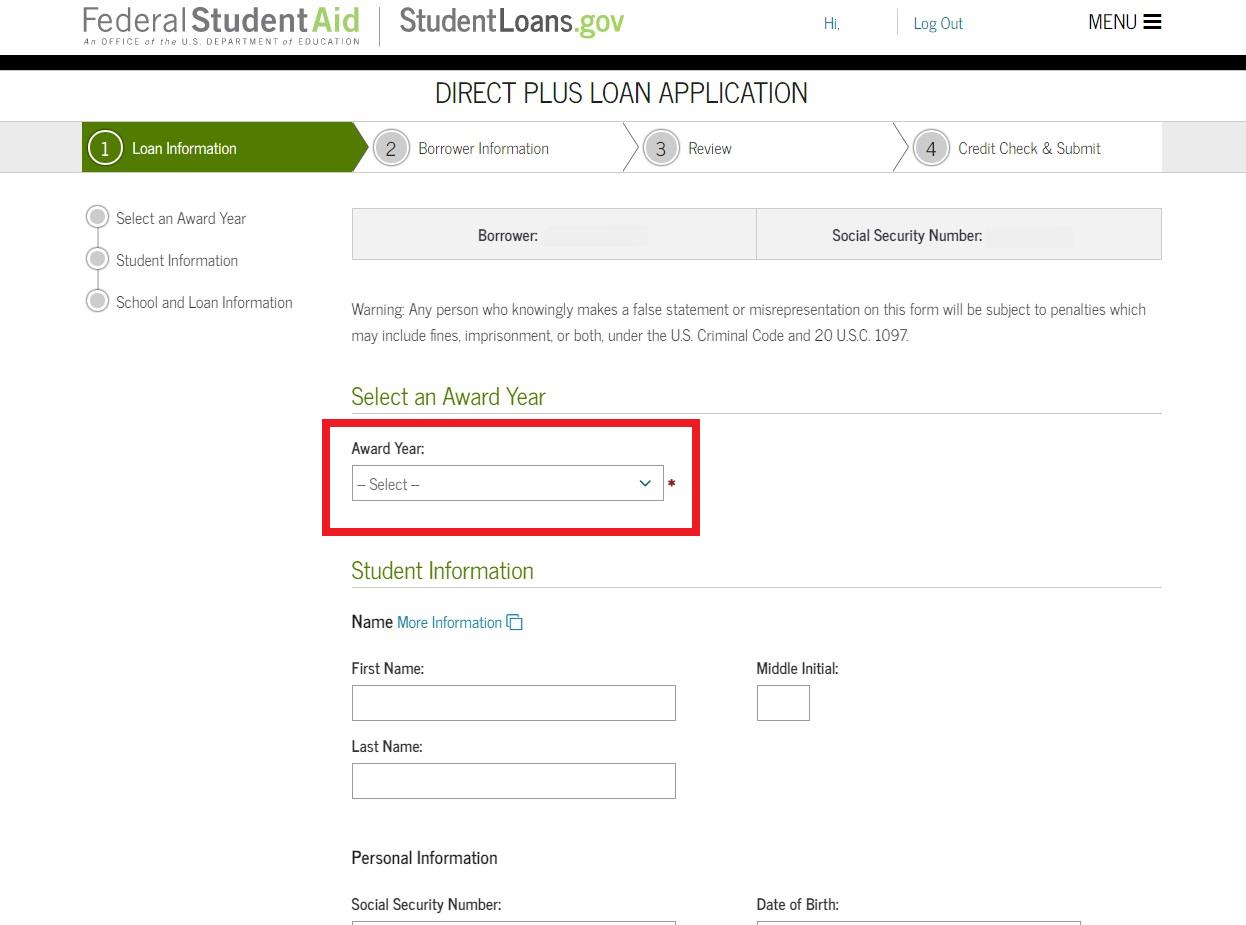

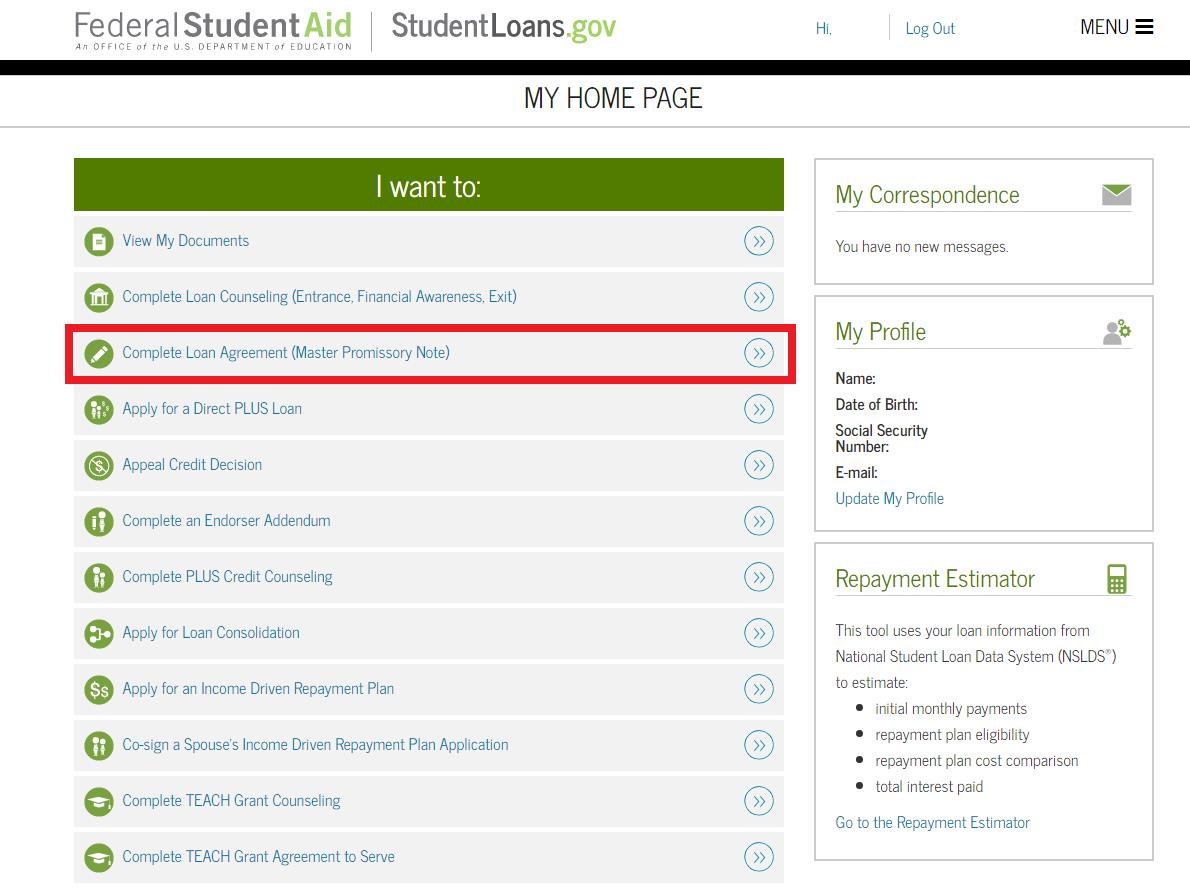

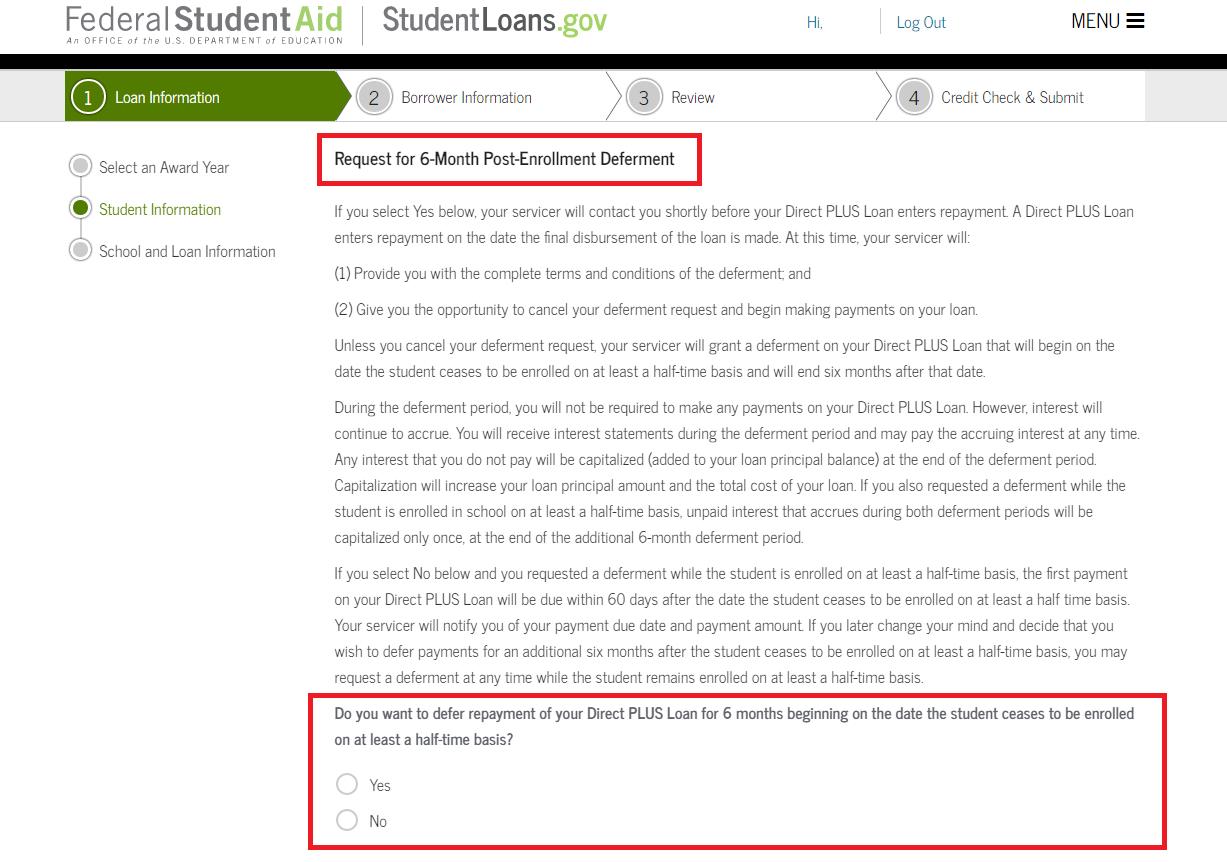

Steps To Apply For A Federal Direct Parent Plus Loan On

Steps To Apply For A Federal Direct Parent Plus Loan On

Parent Plus Loans Student Financial Services Washington State

Parent Plus Loans Student Financial Services Washington State

Federal Direct Parent Plus Loan Office Of Student Financial

Federal Direct Parent Plus Loan Office Of Student Financial

Parent Plus Loans Student Financial Services Washington State

Parent Plus Loans Student Financial Services Washington State

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial Aid

Federal Plus Loans Office Of Scholarships And Financial Aid

Federal Plus Loans Office Of Scholarships And Financial Aid

Federal Direct Parent Plus Loan Office Of Student Financial

Federal Direct Parent Plus Loan Office Of Student Financial