When youre ready to move to a new company but still have an outstanding loan there are a few things you need to know. Workers who need access to their retirement savings early often have the option to take a 401k loan.

Changing Jobs Should You Borrow To Repay A 401k Loan

Changing Jobs Should You Borrow To Repay A 401k Loan

401k loan repayment if you leave company

401k loan repayment if you leave company is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 401k loan repayment if you leave company content depends on the source site. We hope you do not use it for commercial purposes.

Finally realize that when you leave your job any loans that you have outstanding against your 401k need to be repaid.

401k loan repayment if you leave company. If you transfer your old 401k to an ira you cannot borrow from the ira. So i took out a 401k if i leave my company can the loan be deducted from the positive balance from my 401k. 401k loan repayment after leaving a job.

But if you receive a better job offer or are laid off or otherwise leave you could be required to pay the loan back in full or face some serious tax consequences. A loan is almost always the better choice particularly after. You usually have 60 days to repay these loans once you change jobs.

If you need money from your 401k before retirement there are two ways to get it out. The biggest fear that surrounds borrowing from a 401k is what will happen if you leave the job either voluntarily or involuntarily. In some circumstances you may want or need to pay off your 401k loan ahead of schedule.

Changing jobs can be exciting. My employer does not require immediate repayment. You may however be able to speed up the payments before you leave.

Taking a loan or taking a hardship withdrawal. One little discussed but important aspect of the new tax law is the change it makes to the 401k loan repayment and default rules. If you are thinking about taking a loan from your 401k.

The catch is that if you dont pay it back on time or leave your job before repaying the loan. What you need to know about using one in 2020 by candice elliott. Even if you are only two years into a five year 401k loan you will likely be required to repay what you owe.

If you are no longer working for the company where your 401k plan resides you may not take a 401k loan. I may receive commissions for purchases made through links in this post. You may transfer a balance at a former employer to a new 401k plan and if your current employer plan allows for loans then you can borrow from there.

For example you might want to make an extra payment or pay off the loan entirely if you have a sudden financial windfall and you dont want to miss out on market gains because your 401k funds have been lent to you rather than being invested in the market. Heres a look at how 401k loan repayment works. Youll most likely have 90 days to pay the loan back or face the penalties of an early 401k withdrawal.

This post may contain affiliate links at no cost to you.

401k Plan Loan And Withdrawal 401khelpcenter Com

Ex Workers Get More Time To Repay 401 K Loans

401k Layoff Trap How To Repay A 401k Loan

401k Layoff Trap How To Repay A 401k Loan

New 401 K Loan Rules Make Borrowing Slightly Less Risky

New 401 K Loan Rules Make Borrowing Slightly Less Risky

Stuck With A 401k Loan And Leaving Your Job Self Directed

Stuck With A 401k Loan And Leaving Your Job Self Directed

/401k-Loans-Failure-to-Repay-56a090ce3df78cafdaa2c743.jpg) What You Should Know About 401 K Loans

What You Should Know About 401 K Loans

Borrowers Get More Time To Repay 401 K Loans

Understanding 401 K Loan Repayment Rules Lmc Financial

Understanding 401 K Loan Repayment Rules Lmc Financial

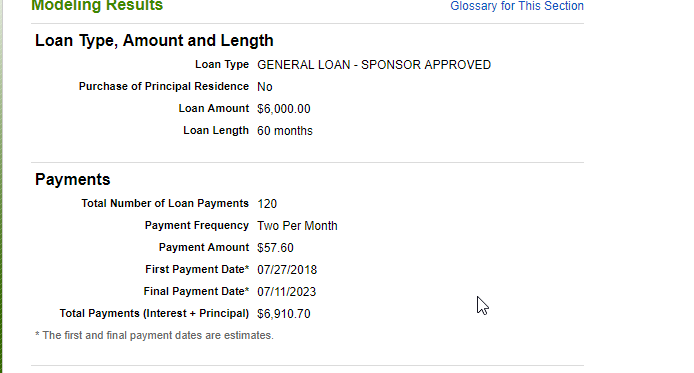

How Do You Repay Back A 401k Loan Bogleheads Org

How Do You Repay Back A 401k Loan Bogleheads Org

/401K-5680cafe3df78ccc15a983c9.jpg) 7 Things To Know About 401 K Loans Before You Take One

7 Things To Know About 401 K Loans Before You Take One

/GettyImages-1000962688-23cf7c48fb5f41cfb756e181dc667e24.jpg) Will I Have To Pay Taxes On My 401 K Plan If I Quit My Job

Will I Have To Pay Taxes On My 401 K Plan If I Quit My Job