A time period during which no finance charges are added to a credit card account. The earnest money that a buyers pay when they put a contract on a property.

Business And Personal Finance Unit 2 Chapter 7

Business And Personal Finance Unit 2 Chapter 7

a long term loan extended to someone who buys property

a long term loan extended to someone who buys property is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in a long term loan extended to someone who buys property content depends on the source site. We hope you do not use it for commercial purposes.

Both parties will advise the agent.

A long term loan extended to someone who buys property. As interest rates rise. Medium term loans can be repaid in monthly instalments over one to five years while long term loans can range anywhere between five years up to 30 years in some cases. Home insurance for damages to the structure of the property.

Log in sign up. What are medium to long term business loans. Medium to long term business loans allow you to borrow funds to help you build your business.

The mortgage will be noted on the title until the term of the home loan is completed. Learn vocabulary terms and more with flashcards games and other study tools. The bank assesses the documents on the basis of income and repayment capacity of the customer and then sanctions the loan.

The cost of credit on a yearly basis. A long term loan extended to someone who buys property usually for10 15 20 25 or 30 years. The reduction of a loan.

Is a long term loan extended to someone who buys property. The escrow account which holds a buyers earnet money. Is a long term loan extended to someone who buys property.

How long does settlement take. The settlement period is the amount of time between the exchange of contracts and the property settlement. Log in sign up.

Extra charges that must be paid by the buyer to the lender in order to get a lower interest rate. A mortgage with a fixed interest rate and a fixed interest rate and a fixed schedule of payments. Is the meeting of the buyer seller and lender of funds or the representatives of each party to complete a real estate transaction.

A long term loan extended to someone who buys property. Under construction property when someone buys an under construction property he has to pay a booking amount to the builder and then apply for a home loan. Extra charges that must be paid by the buyer to the lender in orders to get a lower interest rate.

A long term loan extended to someone who buys a house. Unit 2 test personal finance. The lender not only collects interest on the loan but when the property is sold.

Inactive or not in use. A long term loan extended to someone who buys property. Is the reduction of a loan balance through payments made over a period of time.

What happens and how many days. A long term loan extended to someone who buys property. Fewer people are able to afford the cost of an average sized home.

Chapter 7 Section 3 Home Buying Process Ppt Download

Chapter 7 Section 3 Home Buying Process Ppt Download

Houses Vs Apartments Ppt Download

Houses Vs Apartments Ppt Download

House Hunting Finding Your Own Place Is Exciting But It Is

House Hunting Finding Your Own Place Is Exciting But It Is

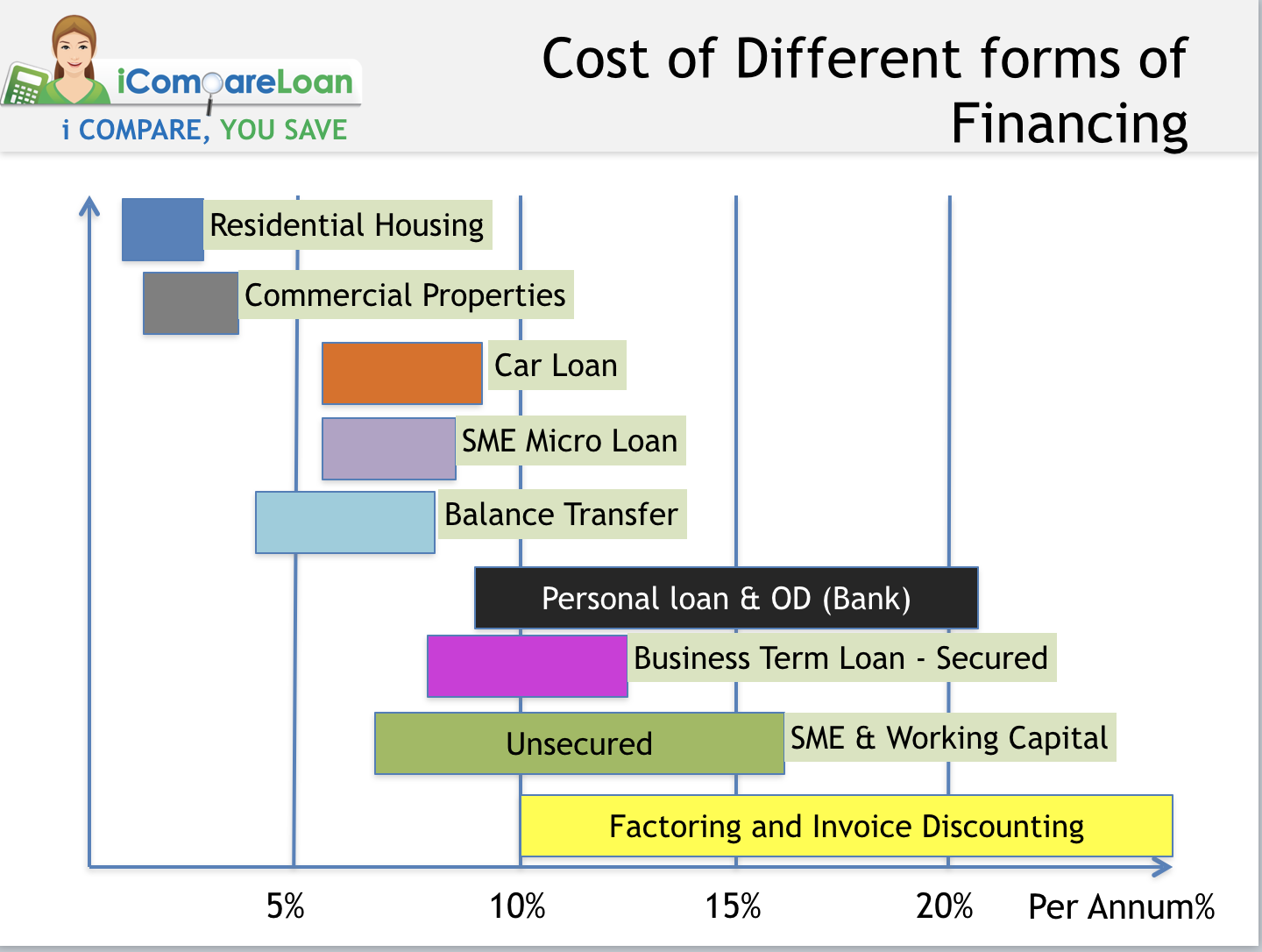

Types Of Loans In Singapore Different Financing Costs And

Types Of Loans In Singapore Different Financing Costs And

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png) How Refinancing Works Pros And Cons Of New Loans

How Refinancing Works Pros And Cons Of New Loans

Ious Personal Loans To Friends And Relatives In Singapore

Ious Personal Loans To Friends And Relatives In Singapore

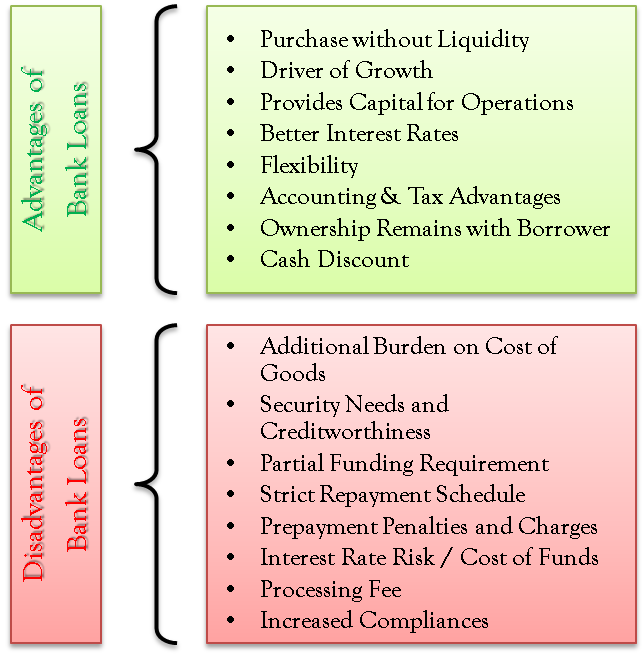

Advantages And Disadvantages Of Bank Loans Efinancemanagement

Advantages And Disadvantages Of Bank Loans Efinancemanagement

Loan Note Payable Borrow Accrued Interest And Repay

Loan Note Payable Borrow Accrued Interest And Repay

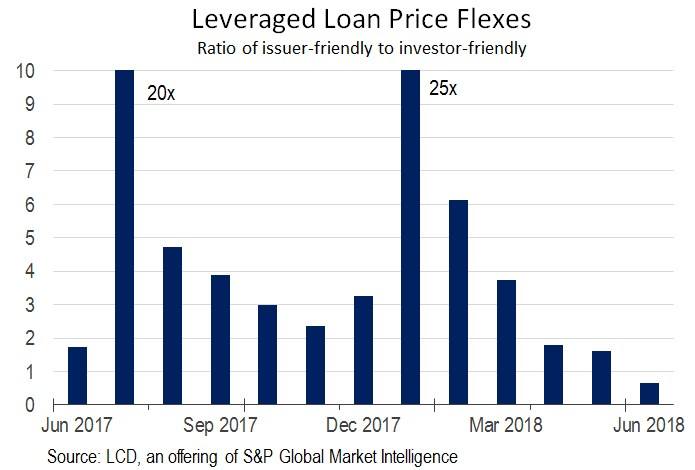

Leveraged Loan Primer S P Global Market Intelligence

Leveraged Loan Primer S P Global Market Intelligence

Company Loans To Directors Shareholders Vice Versa In

Company Loans To Directors Shareholders Vice Versa In