Cost you your home loan from. A personal loan is a type of financing you can obtain from banks credit unions and online lenders.

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Ten Golden Rules To Follow When Taking A Loan The Economic Times

can i take personal loan after home loan

can i take personal loan after home loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i take personal loan after home loan content depends on the source site. We hope you do not use it for commercial purposes.

In case a person has the mo.

Can i take personal loan after home loan. For example you could get a personal loan to pay for a home remodel. The important thing to remember is that if you take the credit card route it will definitely have a large impact on your credit score due to the ratios of utilizing a large balance on your limits. Level of affordability and warns customers to not take on any extra debt after a home loan application.

Before you sign on the dotted line however there are a few things you should know. In the instant case if your income is adequate banks will sanction personal loan apart from home loan. You likely wont have a problem getting a car loan if you have good credit and cash left after buying your home.

A personal loan can be a good option for paying down credit card debt but it might not be the best available option for other things. If you have home equity you could get a home equity loan or open a home equity line of credit. Technically a personal loan can cover both your down payment and closing costs but this defeats the purpose of these payments and your debt to income ratio will likely increase.

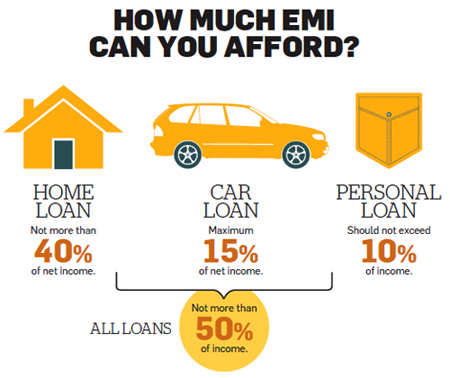

In some cases it can be quicker to take out a personal loan than a home equity loan and you may not have enough equity in your home for a home equity loan in the first place. Yes technically an individual can simultaneously have a personal loan and home loan provided heshe meets all the eligibility criteria of home loan lenders and can easily pay both emis without any defaults or problems. After recovery of emi the take home pay should be 40 of gross pay.

If you are going to be purchasing anything else in the next 12 months car etc then a personal loan is probably going to be the way to go. Personal loans are term loans meaning you borrow a lump sum up front with a fixed rate then you pay back fixed monthly payments for the loan term which usually ranges from two to seven years. If you use a personal loan to pay for your down payment make sure that you have enough money for closing costs.

Auto dealers and lenders also have credit standards and an approval process but generally are more lenient than home loan underwriters. This one mistake can cost you your home. Banks consider take home pay of the employee before sanctioning any loan.

Rbi Keeps Repo Rate Unchanged But No Guarantee Of Relief For Loan

Rbi Keeps Repo Rate Unchanged But No Guarantee Of Relief For Loan

Home Loan Top Up Vs Personal Loan Which One Is Best For You

Home Loan Top Up Vs Personal Loan Which One Is Best For You

Home Loan Top Up Vs Personal Loan Which Is Better For You The

Home Loan Top Up Vs Personal Loan Which Is Better For You The

Personal Loan For Home Loan Down Payment

Personal Loan For Home Loan Down Payment

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Come April 2019 Borrowers Your Emis On Home Loan Personal Loan

Come April 2019 Borrowers Your Emis On Home Loan Personal Loan

Home Renovation Home Loan Top Up Or Personal Loan

Home Renovation Home Loan Top Up Or Personal Loan

Which One Is Better A Top Up Homeloan Or A New Personal Loan

Which One Is Better A Top Up Homeloan Or A New Personal Loan

Things To Consider While Using A Personal Loan For Your Home Loan

Things To Consider While Using A Personal Loan For Your Home Loan

Why A Top Up Home Loan May Be Better Than Business Gold Personal

Why A Top Up Home Loan May Be Better Than Business Gold Personal