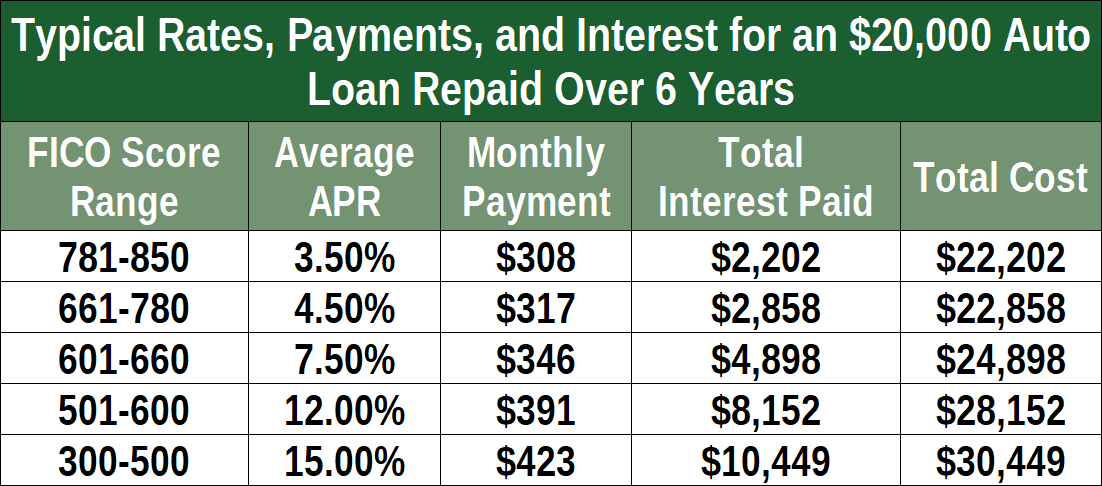

You can see that working to get your score in the higher ranges can mean a big savings. With a lower interest rate youll save money and pay off your car loan faster.

What Is An Appropriate Interest Rate For A Car Loan In 2019

average auto loan interest rate by credit score

average auto loan interest rate by credit score is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in average auto loan interest rate by credit score content depends on the source site. We hope you do not use it for commercial purposes.

On average the interest rates for used car loans tend.

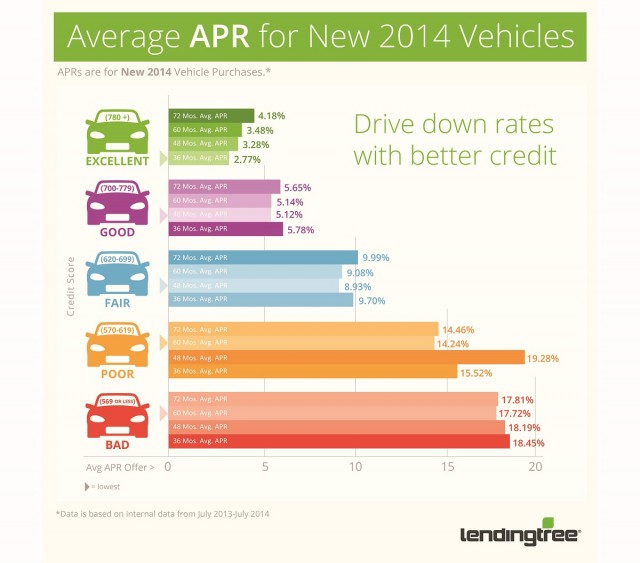

Average auto loan interest rate by credit score. Because fico doesnt share or sell the fico auto score to consumers its only possible to show the average rate of a car loan using a typical credit score. The longer your term is the higher your rate will be. Youll notice that there is a lot of real estate between the lowest rate and the highest one.

A 650 credit score auto loan interest rate can vary based on the lender you choose down payment and even debt to income ratio. While this is not as accurate as the score used by those in the auto industry it gives you a close approximation as to what your interest rate may be when purchasing a car. This is because lenders charge higher interest rates to borrowers with poor credit.

Before financing a vehicle you should look up the average interest rates you can expect based on your credit score. The interest rate youll get depends on your credit score and income the length of the loan you choose and the vehicle. The loan savings calculator shows how fico scores impact the interest you pay on a loan.

Average used car loan rates based on fico score. The average interest rate for a car loan is higher if you have bad credit than if you have a good credit score. Get the lowest rate when you compare rates from multiple lenders even if your credit isnt perfect.

The national average for us auto loan interest rates is 421 on 60 month loans. For individual consumers however rates vary based on credit score term length of the loan age of the car being financed and other factors relevant to a lenders risk in offering a loan. Todays auto loan rates are displayed in our helpful car loan calculator.

It pays to shop for the best car loan rate. Select your loan type and state enter the appropriate loan details and choose your current fico score range. Ideally you want to apply for a car loan when your fico score is high.

Now lets look at the average used car loan rates based on fico scores. Also loan terms either 36 48 or 60 month loans can affect your rate as well. Individuals with a 700 fico credit score pay a normal 468 interest rate for a 60 month new auto loan beginning in august 2017 while individuals with low fico scores 590 619 were charged 137 in interest over a similar term.

What to know before you apply for an auto loan. A higher fico score saves you money. Credit reporting bureau experians latest analysis of the automotive finance market shows that the average interest rate on a new car loan is 613 percent marking the first time in 10 years.

Your Credit Score Your Auto Loan 4 Things You Can Do To

Your Credit Score Your Auto Loan 4 Things You Can Do To

Average Loan Interest Rates Car Home Student Small

Average Loan Interest Rates Car Home Student Small

650 Credit Score Car Mortgage Esther Vanhorn Blog

What Are The Credit Score Requirements For An Auto Loan

What Are The Credit Score Requirements For An Auto Loan

Study When Does Refinancing An Auto Loan Work Best

Study When Does Refinancing An Auto Loan Work Best

How To Improve Your Credit Score 4 Easy Tricks Anyone Can Do

How To Improve Your Credit Score 4 Easy Tricks Anyone Can Do