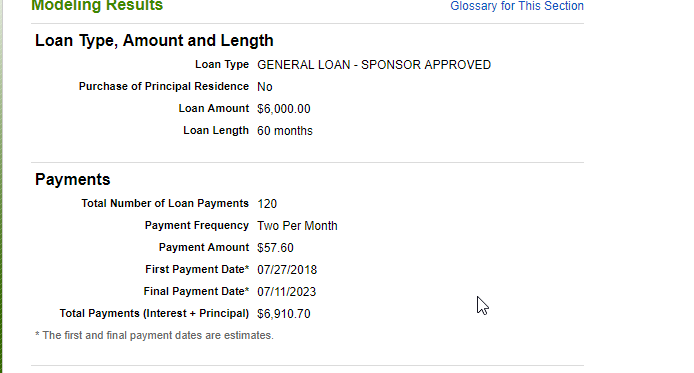

This is a great option for me as i have a strong comfort level with fidelity as i have had a brokerage account there for years. Once you request the money you enter a plan to pay it back much like a traditional loan except that you dont have a lender.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

can i get a loan against my 401k

can i get a loan against my 401k is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i get a loan against my 401k content depends on the source site. We hope you do not use it for commercial purposes.

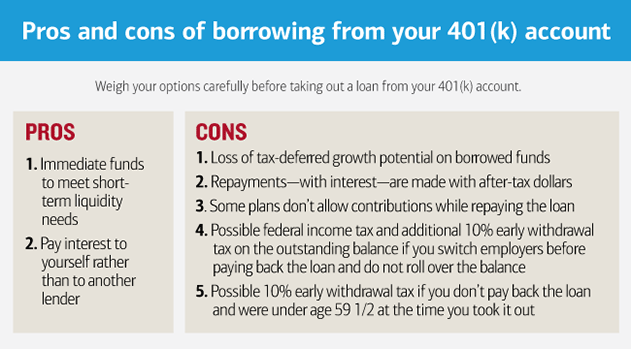

If you are thinking about taking a loan from your 401k make sure you know the rules and how the loan will need to be repaid.

Can i get a loan against my 401k. It goes against personal finance philosophy to take money out of a retirement account before retirement but under the right circumstances it is something to consider. To help avoid the need to borrow in the future and get your finances on track consider budgeting building up an emergency fund and cutting back on credit card debt. Heres a look at how 401k loan repayment works.

Indeed the first 401k loan can act as a gateway to serial borrowing. When done for the right reasons taking a short term 401k loan and paying it back on schedule isnt necessarily a bad idea. Consult with a financial planner or tax advisor who can.

When is it ok to borrow against your 401k. Here are 6 things you must know about your 401k plan by age 55. 7 things to know about 401k loans before you take one loan eligibility.

Borrowing against 401k question. Taking out a 401k loan can undermine your savings and potential investment growth. Learn answers to your most common.

But before you decide to borrow against your 401k be sure to consider your alternatives. As long as you have a vested account balance in your 401k and if your plan permits loans you can likely be allowed to borrow against it. If you need a loan one way to get it without having to meet a lenders high credit standards is to request a loan from your 401k.

Thinking about a 401k loan. My solo 401k funds are in a brokerage account at fidelity. Then things can get.

Compare the fees and interest rates for a 401k loan and commercial loans. If you must take a 401k loan dont stop saving for retirement. Explore other financial resources that may be available to you eg selling an asset reducing monthly expensesluxuries.

Reasons to borrow from your 401k include speed and convenience. A good way to see just how damaging and expensive a retirement plan loan can be to your financial future is to use the. Those considering a 401k loan should compare the rates they can get on other types of loans.

A 401k is meant to fund retirement but you can withdraw money from it earlier. Plan administrator or investment company to find out if your plan allows you to borrow against your account balance. How can i get a loan from my 401k.

You can usually find their contact information on.

Can I Borrow Against My 401k Plan Not If You Can Help It

Can I Borrow Against My 401k Plan Not If You Can Help It

401k Plan Loan And Withdrawal 401khelpcenter Com

Can I Borrow Money Or Take A Loan From My 401 K

Can I Borrow Money Or Take A Loan From My 401 K

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

401 K Loans A Good Option For Your Company Fisher 401k

401 K Loans A Good Option For Your Company Fisher 401k

:brightness(10):contrast(5):no_upscale()/401K-5680cafe3df78ccc15a983c9.jpg) 7 Things To Know About 401 K Loans Before You Take One

7 Things To Know About 401 K Loans Before You Take One

How My 401k Loan Cost Me 1 Million Dollars Making Sense Of Cents

How My 401k Loan Cost Me 1 Million Dollars Making Sense Of Cents

At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

How Do You Repay Back A 401k Loan Bogleheads Org

How Do You Repay Back A 401k Loan Bogleheads Org

Better Example Against Double Taxation Of 401 K Loans My Money Blog

Better Example Against Double Taxation Of 401 K Loans My Money Blog