Asking a few key questions beforehand can help you decide if it makes sense for your situation. A 30 year refinance extends the time you take to repay from your current term back to 30 years.

15 Year Refinance Mortgage A Smart Move In 2019

15 Year Refinance Mortgage A Smart Move In 2019

can i refinance to a 15 year loan

can i refinance to a 15 year loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i refinance to a 15 year loan content depends on the source site. We hope you do not use it for commercial purposes.

If a 15 year refinance doesnt fit your budget you can always consider refinancing into a 20 or 30 year loan and making higher payments to eliminate your mortgage faster and reduce the amount.

Can i refinance to a 15 year loan. A full point of interest is the usual difference. On top of that youd also pay less in interest. Estimate your new monthly mortgage payment savings and breakeven point.

When you take out a 15 year loan at 325 61 of the first payment goes to paying down your principal. For example if you currently have 15 years left on your mortgage refinancing to a 30 year loan would allow you. In a word no.

Try our easy to use refinance calculator and see if you could save by refinancing. However if you want to have even lower monthly payments you can stretch out the repayment by refinancing back into a 30 year refinance. A 15 year mortgage can be a great way for young people to commit to growing their net worth.

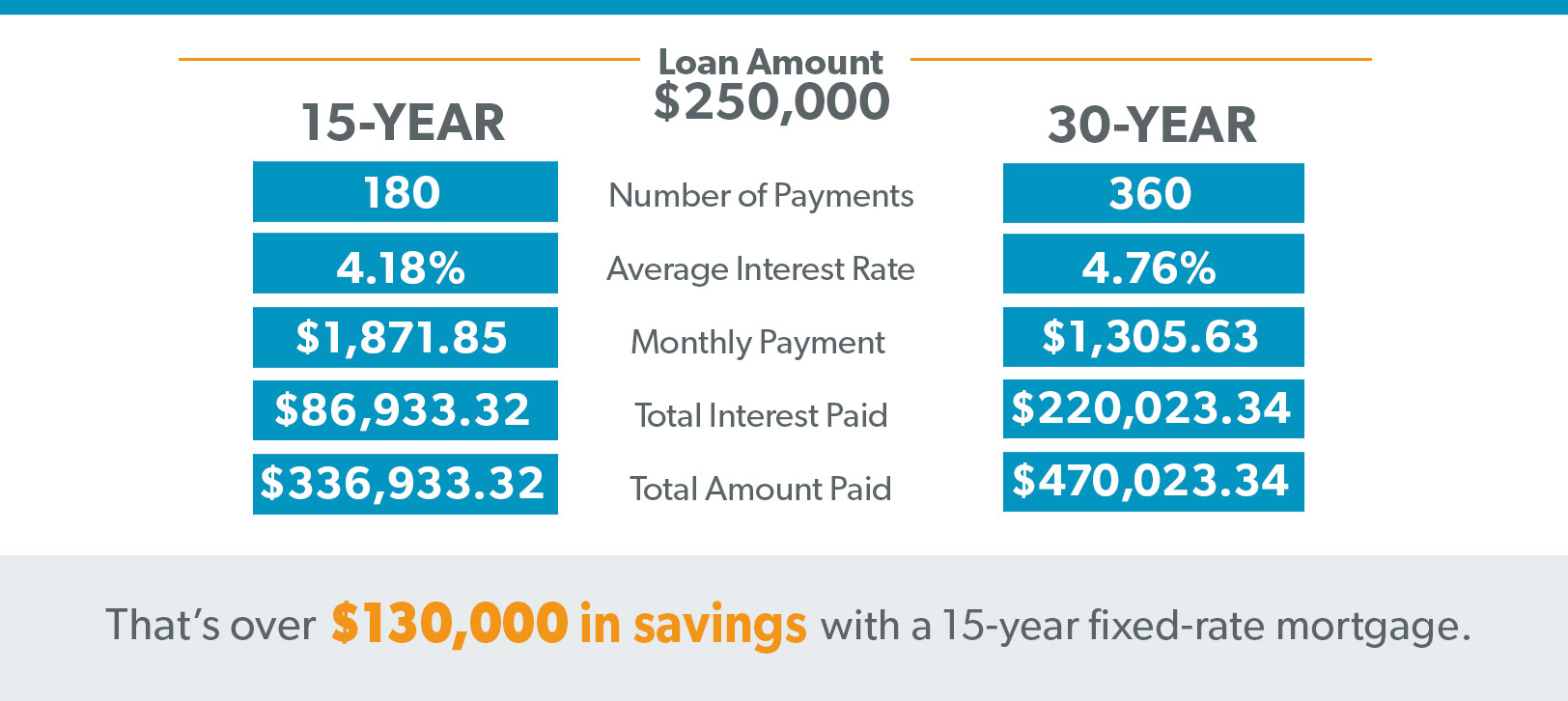

I wrote a blog back in 2011 in another feverish refinance market showing the numbers on how you cant shorten the term of your loan from 30 to 15 years without increasing your monthly mortgage payment. Those numbers bear repeating in the current interest rate climate and are below. Should you refinance a 30 year va loan to a 15 year mortgage.

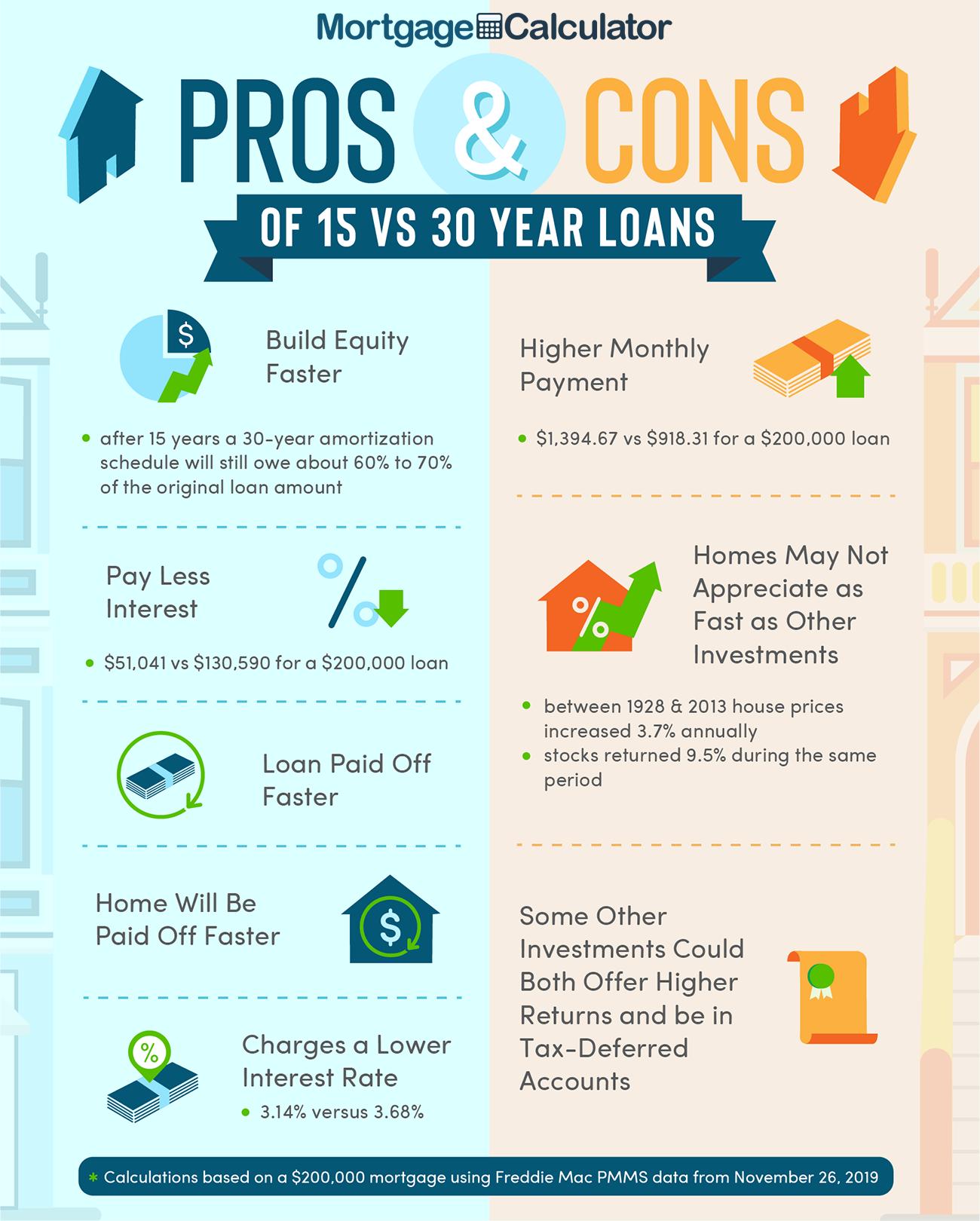

Should you refinance a 15 year mortgage. It will save you money compared to a 30 year fixed rate mortgage. If youre tired of having mortgage debt refinancing from a 30 to a 15 year loan would allow you to pay it off faster.

Refinancing from a 30 year fixed rate mortgage into a 15 year fixed loan can help you pay down your mortgage faster and save a ton of money on interest especially if rates have fallen since you. This is not possible. A 15 year fixed rate mortgage is a home loan with a repayment term of 15 years.

It offers borrowers the same fixed interest rate and monthly payments throughout the life of the loan. By comparison just 38 of the first payment on a 30 year 325 interest rate loan goes to principal. Ryan im looking at my mortgage situation and am considering refinancing my va loan from a 30 year mortgage to a 15 year mortgage because we can save thousands of dollars throughout the mortgage.

Commitment to grow your net worth. Refinancing to a 15 year mortgage has some definite perks but its not right for everyone.

The Benefits Of Refinancing Into A 15 Year Loan Gmfs Mortgage

The Benefits Of Refinancing Into A 15 Year Loan Gmfs Mortgage

Why The 15 Year Fixed Rate Mortgage Has Benefits Refiguide Org 2020

Why The 15 Year Fixed Rate Mortgage Has Benefits Refiguide Org 2020

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm

Why You Should Refinance To A 15 Year Fixed Rate Mortgage Now

Why You Should Refinance To A 15 Year Fixed Rate Mortgage Now

How Refinancing Works Pros And Cons Of New Loans

How Refinancing Works Pros And Cons Of New Loans

Should You Refinance From A 30 Year To A 15 Year Mortgage

Should You Refinance From A 30 Year To A 15 Year Mortgage

Fixed Rate Mortgage Definition Types Pros And Cons

Fixed Rate Mortgage Definition Types Pros And Cons

15 Year Vs 30 Year Mortgage If You Aren T Doing The Dave Ramsey

15 Year Vs 30 Year Mortgage If You Aren T Doing The Dave Ramsey

Is Refinancing Into A 15 Year Mortgage A Good Idea Bankrate

Is Refinancing Into A 15 Year Mortgage A Good Idea Bankrate