Standard repayment plans for federal student loans set a timeline of 120 months until payoff but the minimum monthly payments are 50. The amount of interest charged for private student loans is typically higher than the interest for taking out a federal student loan.

Banking On Your Future Post Test By Computers For Kids

Banking On Your Future Post Test By Computers For Kids

borrowing a subsidized federal student loan means everfi

borrowing a subsidized federal student loan means everfi is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in borrowing a subsidized federal student loan means everfi content depends on the source site. We hope you do not use it for commercial purposes.

Subsidized loans are federal student loans which are made available to eligible students to help finance a higher education.

Borrowing a subsidized federal student loan means everfi. A subsidized student loan is a. What is a direct subsidized loan. In this example it would take me much less time 81 months vs.

The graduate stafford student loan is the best available. Students should use federal student loans to the extent they are available and consider private loans only when federal aid isnt enough to pay for education. Others are available to any enrolled student.

99 months and much less money 4050 vs. Pay back after. A loan from a bank rates are higher and stricter repayment consider after federal student loans.

Subsidized means it is need based and. Although loan terms may vary temple uses a scheduled academic year that begins with the fall semester. It depends on a few things like which loan you get federal private subsidized.

A stafford loan is a type of federal fixed rate student loan available to college and university undergraduate graduate and professional students attending college at least half time. Some loans are need based. The government pays interest on a subsidized loan while youre enrolled in school at least half time.

Everfi module 1 savings final quiz answers 21 terms. 4950 to pay back a subsidized loan vs an unsubsidized loan. Borrowing a subsidized federal student loan means.

Learn vocabulary terms and more with flashcards games and other study tools. Start studying personal finance semester test. Subsidized means it is.

Subsidized means that an eligible borrower does not incur interest charges on the subsidized portion of their federal student loan while enrolled at a participating institution on at least a half time basis. Direct subsidized loans are federal loans where the federal government will pay the interest while the student is in school explained fred amrein founder and owner of amrein financial. Whether interest is subsidized or unsubsidized makes a significant difference in the amount of money owed upon graduation even when borrowing the same amounts of money.

An undergraduate financial aid offer may include a combination of federal direct subsidized and unsubsidized loans. The interest rate for subsidized and unsubsidized undergraduate student loans for the 2018 2019 academic year is 505 percent.

Banking On Your Future Post Test By Computers For Kids

Banking On Your Future Post Test By Computers For Kids

Teen And College Student Money Tips What To Know By Age 20

Teen And College Student Money Tips What To Know By Age 20

Everfi Instructional Technology The University Of Tennessee

Everfi Instructional Technology The University Of Tennessee

Teen And College Student Money Tips What To Know By Age 20

Teen And College Student Money Tips What To Know By Age 20

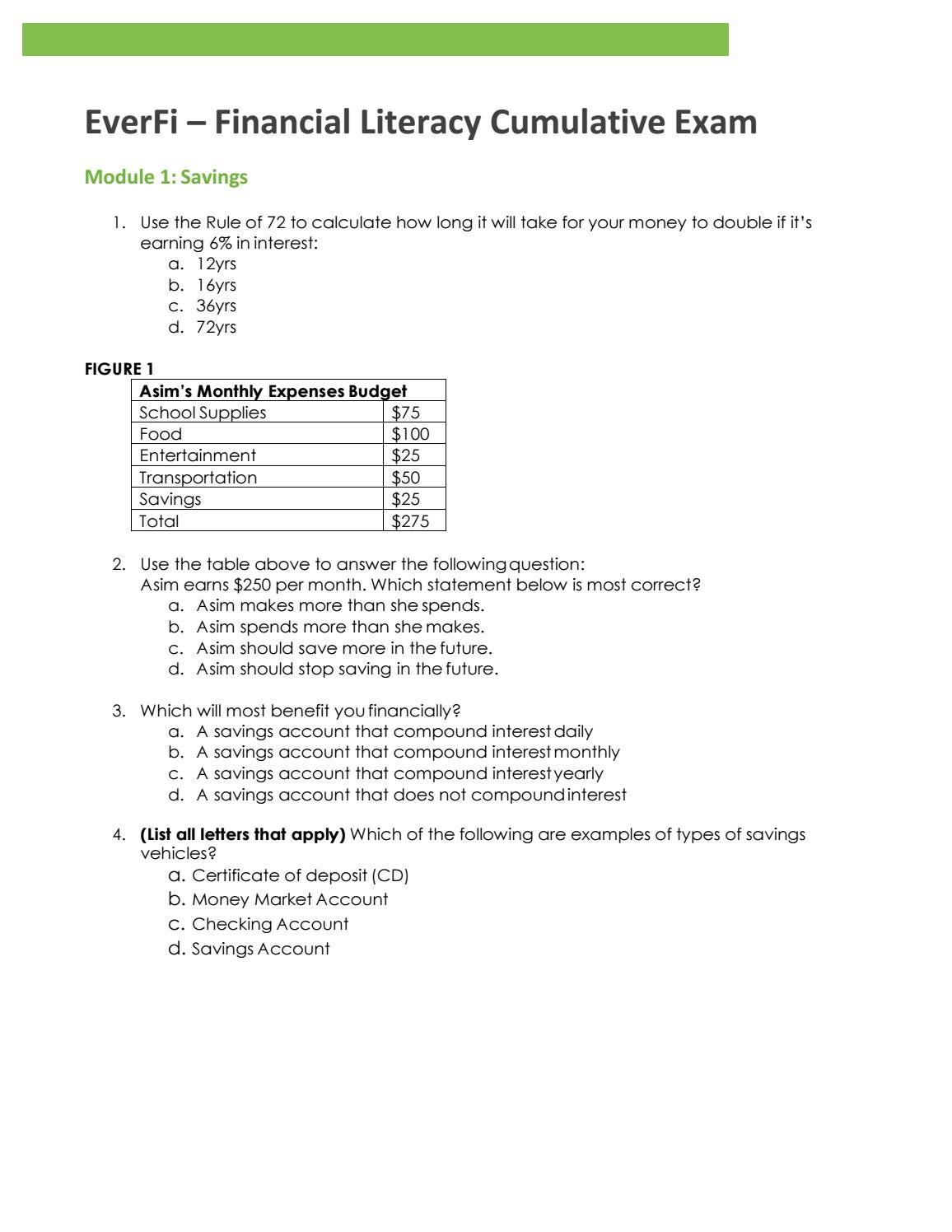

Hs Economics With Fin Lit And Honors 2017 2018 Edited 2

Ppt What Every Financial Educator Should Know About

Ppt What Every Financial Educator Should Know About

11 02 Everfi Financial Literacy 2 0 Curriculum

11 02 Everfi Financial Literacy 2 0 Curriculum

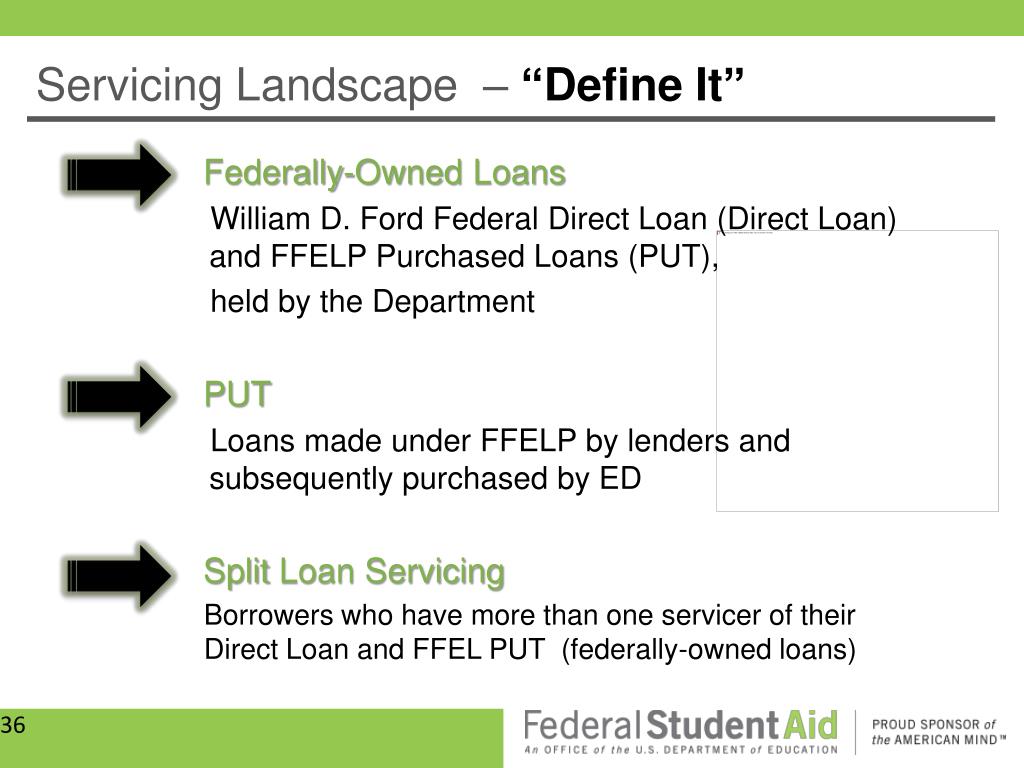

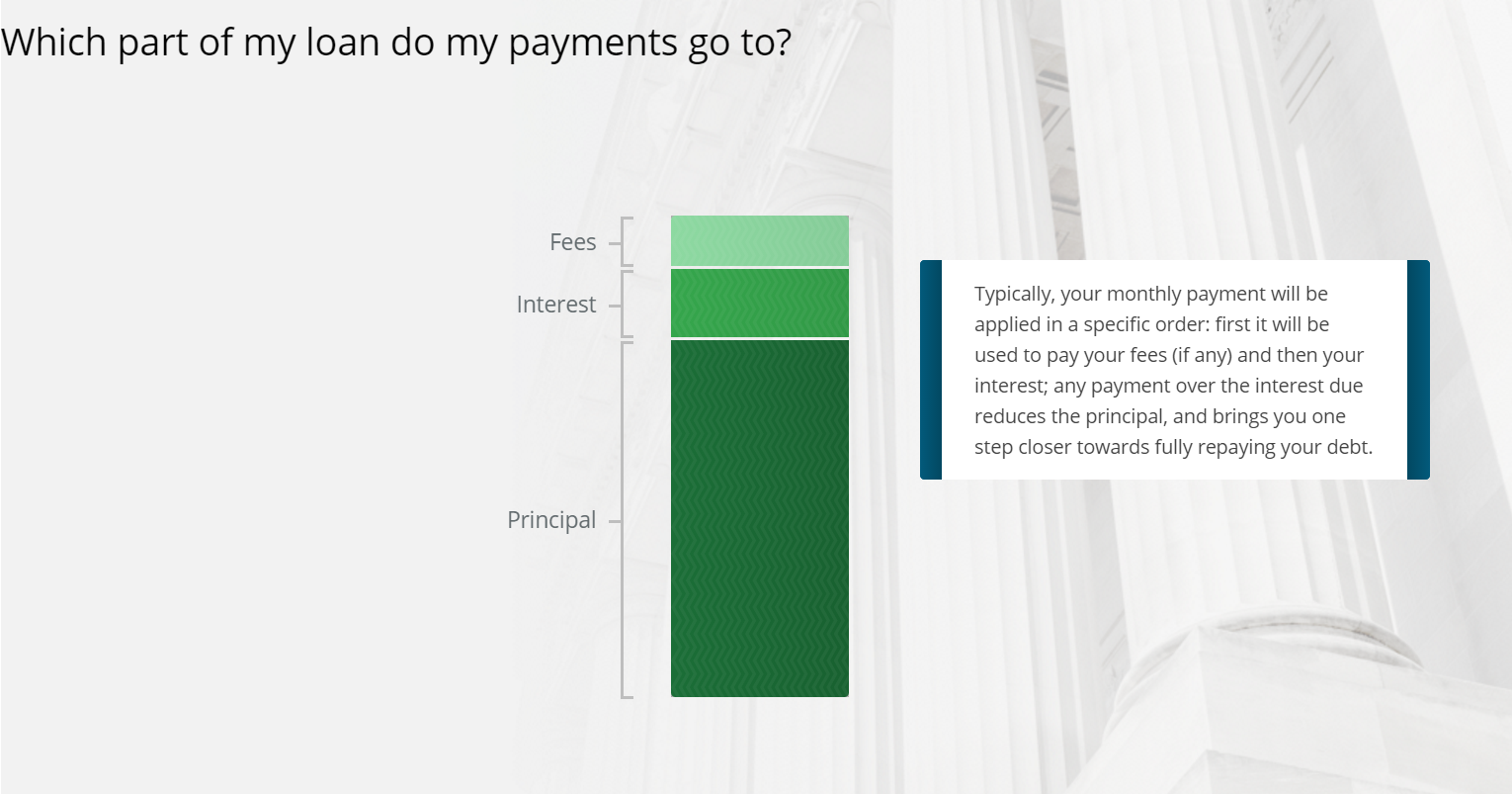

Borrower Question How Do I Pay Toward The Principal Of My

Borrower Question How Do I Pay Toward The Principal Of My

Ppt What Every Financial Educator Should Know About

Ppt What Every Financial Educator Should Know About

Ppt What Every Financial Educator Should Know About

Ppt What Every Financial Educator Should Know About