See if youre pre qualified for a capital one credit card. In case a person has low credit score it might be difficult to get this loan.

Is A Credit Card A Type Of Loan

Is A Credit Card A Type Of Loan

a credit card is a type of loan

a credit card is a type of loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in a credit card is a type of loan content depends on the source site. We hope you do not use it for commercial purposes.

This type of debt does carry some of the industrys highest interest rates.

A credit card is a type of loan. Thus if the cardholder puts down 1000 they will be given credit in the range of 5001000. Credit card debt can be useful for borrowers seeking to make purchases which allow for deferred payment over time. The credit card issuer essentially loans you the money to make the purchase and you will be able to repay that loan at a later date while being charged a certain interest rate.

To start the process of finding a loan to pay off your credit card debt you need to have an exact goal in mind as the type of loan you seek will depend largely on its purpose. This is definitely a superior and more practical option to clear debts than a credit card loan as they have much more higher rate of interest. Consolidation loans are typically in the form of second mortgages or personal loans.

A revolving account is a type of credit account which provides a borrower with a maximum limit and allows for varying credit availability. Because of that its generally not a good idea to use a home equity loan as a debt consolidation loan. Considering a loan or a line of credit.

These loans are also a better option to pay off credit card debts. With savor earn unlimited 4 cash back on dining and entertainment. Loans mortgages savings investments and credit cards.

While the interest rates are typically lower than other types of loans the drawback is that your home is now on the line for your credit card and other accumulated debt. Typically the cardholder must deposit between 100 and 200 of the total amount of credit desired. Simply put a consolidation loan pays off all or several of your outstanding debts particularly credit card debt.

A secured credit card is a type of credit card secured by a deposit account owned by the cardholder. A consolidation loan is meant to simplify your finances. Credit cards serve many useful functions including the ability to pay for purchases when you dont have cash on hand.

We use cookies to give you the best possible experience on our website. If the payments become unaffordable you face foreclosure on your home. In general personal loans can be placed into one of two categories based on the length of the loan.

It means fewer monthly payments and lower interest rates. The interest rates are lower in this situation. Dine out cash in.

Enjoy a range of financial products and services with hsbc personal and online banking.

Types Of Loans Credit Different Credit Loan Options

Types Of Loans Credit Different Credit Loan Options

Which To Choose Credit Card Vs Personal Loan

Which To Choose Credit Card Vs Personal Loan

Credit Card Loan Definition And Meaning Market Business News

Credit Card Loan Definition And Meaning Market Business News

What Is The Difference Between A Personal Loan Credit Card

Types Of Credit Cards Loan Away

Types Of Credit Cards Loan Away

Taking A Loan Against Your Credit Card Here Are Some Things

Taking A Loan Against Your Credit Card Here Are Some Things

Why Are American Express Revenues 4x Discover S Despite

Why Are American Express Revenues 4x Discover S Despite

Top 5 Things To Consider When Getting Credit Cards In Singapore

Top 5 Things To Consider When Getting Credit Cards In Singapore

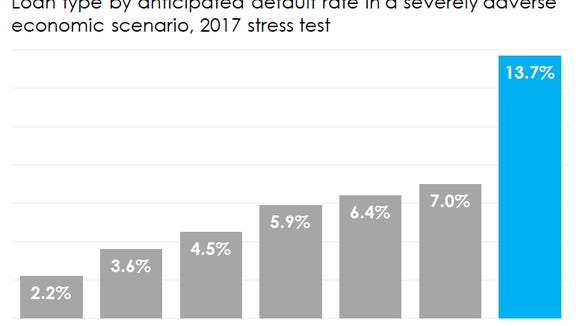

Chart Credit Card Loans Are Much Riskier Than Other Types

Chart Credit Card Loans Are Much Riskier Than Other Types

6 Best Loans To Pay Off Credit Card Debt 2020

6 Best Loans To Pay Off Credit Card Debt 2020