We will refund the fees you paid us to use our program to prepare that return and you may use our program to amend your return at no additional charge. There may be times you can claim irs car tax deductions for interest paid on a car loan to help lower the amount of federal taxes you owe.

Is Car Loan Interest Tax Deductible

Is Car Loan Interest Tax Deductible

can you claim interest paid on car loan on taxes

can you claim interest paid on car loan on taxes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you claim interest paid on car loan on taxes content depends on the source site. We hope you do not use it for commercial purposes.

Interest paid on personal loans is not tax deductible.

Can you claim interest paid on car loan on taxes. If you have a large amount of equity and a large first mortgage loan you may not be able to deduct all the combined interest paid. Lean more about deducting car loan interest with. In 2017 the mortgage interest deduction included that which you paid on loans to buy a home on home equity lines of credit and on construction loans.

Car loan interest can add thousands of dollars to the price of a new car or truck. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax. But the tcja eliminated the deduction for home equity debt beginning with the 2018 tax yearthe return youll file in 2019 unless you can prove that the loan was taken out to substantially improve your residence.

So being able to deduct the interest on your taxes can help reduce the overall cost of ownership. Having said that if you keen to get benefit for same you may rather apply for a lease rather tha. After all interest on student loans is deductible under certain circumstances and so is interest up to a certain amount on homes.

This amount gets adjusted every year. No car loan doesnt reduce your income tax liability. However all types of interests are not allowed to be claimed as an expense.

Use the irs online student loan assistance tool to see if you can deduct the interest paid on a student loan. Auto loan interest can add up to quite a bit over time so you might wonder if this charge is tax deductible. Since interest on older mortgages is grandfathered to 1 million.

Well if you buying car on finance then there is no benefit on interest payable on car loan. To qualify the larger refund or smaller tax liability must not be due to differences in data supplied by you your choice not to claim a. The interest paid on some types of loans is allowed to be claimed as an expense under the income tax act.

To qualify for the student loan interest deduction your modified adjusted gross income must be less than 80000 165000 for couples filing jointly in 2019. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases. The most common reasons for which people take loans are when they intent to buy a home or a car.

You cant claim a car tax deduction for any part of a car loan if you use the vehicle solely for personal driving but you can deduct a portion of the interest on schedule c if youre self employed and use the vehicle at least in part for purposes related to your business.

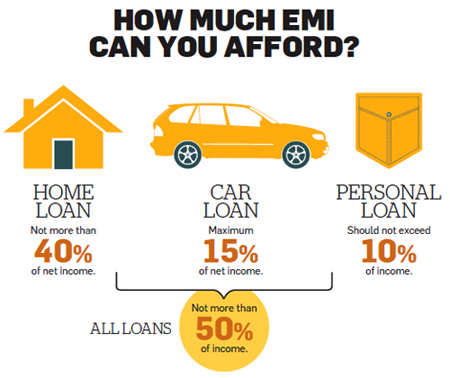

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Compute Loan Interest With Calculators Or Templates

Compute Loan Interest With Calculators Or Templates

Tips To Use All The Tax Benefits That Are Available On Home

Tips To Use All The Tax Benefits That Are Available On Home

:max_bytes(150000):strip_icc()/GettyImages-1148171551-a60119b7ac2c4653b12c48b4e40b2b81.jpg) Tax Deductible Interest Definition

Tax Deductible Interest Definition

:max_bytes(150000):strip_icc()/loan_shutterstock_573964660-5bfc316e46e0fb0083c18cfd.jpg) Tax Deductible Interest Definition

Tax Deductible Interest Definition

How To Calculate Interest Rates On Bank Loans

How To Calculate Interest Rates On Bank Loans

Are Your Business Loans Tax Deductible

Are Your Business Loans Tax Deductible

/curved-skyscraper-against-blue-sky-969510128-a2a10be3bbd04d91a6375ffa3cdea790.jpg) Tax Deductible Interest Definition

Tax Deductible Interest Definition

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020