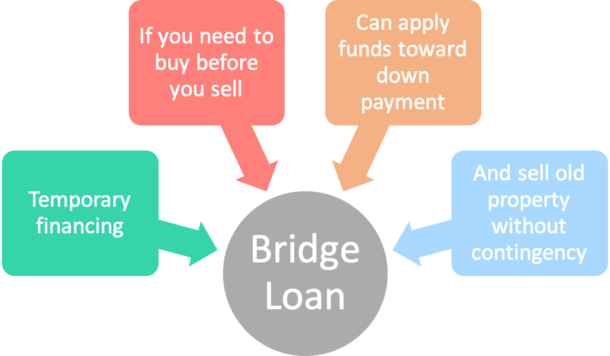

Also known as a swing loan gap financing or interim financing a bridge loan is typically good for a six month period but can extend up to 12 months. With home loan rates this low now is the time to get approved and locked into the lowest rate va loan will you can.

Bridge Loans Ease The Transition Between Homes At A Cost

Bridge Loans Ease The Transition Between Homes At A Cost

can you do a bridge loan with a va loan

can you do a bridge loan with a va loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you do a bridge loan with a va loan content depends on the source site. We hope you do not use it for commercial purposes.

A bridge loan can help you buy a new house before your current home sells but its expensive and risky.

Can you do a bridge loan with a va loan. Were going to explain what bridge loans are and how they work so you can decide for yourself if they would be a good option for you. This no down payment program allows qualified borrowers to use their va loan entitlement to obtain a mortgage for new construction. Unless you want to sell your home and move into a temporary living situation until you move into your new house youll need a bridge loan.

Building your dream home is a possibility with a va home loan. Finance your housing transition. Bridge loans can help borrowers move from one home to the next but they can be dangerous.

If you find the home you want to purchase before you have sold your current home you can take out this type of loan in which the equity in your current property is used as the downpayment on the new property you are purchasing. Other options for your new home purchase include usda home loans or va. You cant qualify for a new loan until you your current home is sold.

The va home county loan limits were eliminated as part of the blue water navy vietnam veterans act of 2019 for veterans and. But it can be challenging to find lenders willing to make a true 0 down va construction loan. A bridge loan usually runs for six month terms and is secured by the borrowers old home.

If you dont have the cash and your existing home hasnt sold you can fund the down payment for the move up home in one of two common ways. Second you can take out a home equity loan or home equity line of credit. Consider these two alternatives before you apply.

A bridge loan is essentially a short term loan taken out by a borrower against their current property to finance the purchase of a new property. Our va loan officers have a full understand of the va guidelines and requirements for the va loan program. 1 2020 it became easier for you to use your va home loan benefit to purchase refinance or construct a home with no down payment regardless of the cost of the home.

The biggest advantage of a bridge loan is that it can allow you to buy. But it isnt always an easy road. First you can finance a bridge loan.

Va home mortgages are managed through private home loan lenders so you do not have to struggle with government financing.

How A Bridge Loan Can Help You Buy Your Next House Nerdwallet

How A Bridge Loan Can Help You Buy Your Next House Nerdwallet

Bridge Loans Finance Your Housing Transition Mortgage Rates

Bridge Loans Finance Your Housing Transition Mortgage Rates

What Is A Bridge Loan And How Do They Work For Homeowners Looking

What Is A Bridge Loan And How Do They Work For Homeowners Looking

Bridge Loans And Home Purchase Bridge Loans The Truth About Mortgage

Bridge Loans And Home Purchase Bridge Loans The Truth About Mortgage

Your Next Va Home Loan Vantage Point

Your Next Va Home Loan Vantage Point

16 Reasons Appraisals Come In Low

16 Reasons Appraisals Come In Low

6 Ways To Finance Real Estate Investments Millionacres

6 Ways To Finance Real Estate Investments Millionacres

Va Busts Four Home Loan Myths That Hurt Veteran Homebuyers

Va Busts Four Home Loan Myths That Hurt Veteran Homebuyers

What Is A Bridge Loan And How Do They Work The Lenders Network

What Is A Bridge Loan And How Do They Work The Lenders Network