Home loan exit fees can make all the difference between a seemingly good deal and a bad one. Anzs basic variable loan is the cheapest with total exit fees of 860 followed by cba and nab charging 1050 each with westpac the most expensive at 1150 which is 43 more than the.

Finance Fees And Charges Pdf Free Download

Finance Fees And Charges Pdf Free Download

anz fixed rate home loan exit fees

anz fixed rate home loan exit fees is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in anz fixed rate home loan exit fees content depends on the source site. We hope you do not use it for commercial purposes.

Interest rates and fees are subject to change.

Anz fixed rate home loan exit fees. However fixed rate break costs and discharge fees still apply. The main reason to take out a home equity loan is that it offers a anz fixed home loan exit fee cheaper way of borrowing cash than unsecured personal loans. By using your property as collateral lenders are willing to take on more risk than if they were only assessing you by your credit score which means larger loans and better interest rates.

Every home loan has a small discharge fee typically 350 per property which covers the cost of the lender removing the mortgage that has been registered on the title of. A fixed rate home loan is a legal contract guaranteeing that youll repay a fixed amount of interest on a loan for a specified time period. Bundle your home loan and everyday account into an anz breakfree package with ongoing benefits and discounts for an annual fee of 395.

An anz home loan or anz residential investment property loan on a variable rate offers the following. Your interest rate can go up or down in line with the market. An early repayment recovery based on the economic loss to anz of repaying or restructuring in full or part your anz fixed rate home loan as set out in your anz loan agreement.

This material is for information purposes only. How about a combination of loans. You can make extra repayments on your home loan any time you like.

You can split your home loan into any combination of fixed and variable home. It is also based on a loan term of 30 years repayment type principal and interest and either an anz standard variable rate for home loans or an anz standard variable rate for residential investment property loans depending on the type of property you have selected. Enquire now if you take out a 250000 anz standard variable home loan with a interest rate discount and fee waivers under the anz breakfree package.

This 2 year fixed anz breakfree package rate comes with package discount and product bundle. If you decide to break that contract by switching loans. This estimate is based on the accuracy of the limited information provided.

If your home loan is fixed or if it was setup before july 2011 then you may still have significant exit fees. If youre repaying some or all of your loan early during a fixed rate period you may have to pay us an early repayment recovery. A copy of the banks general disclosure statement under the reserve bank of new zealand act 1989 is available on this website or on request from any anz branch free of charge.

Anz lending criteria terms conditions and fees apply.

Fixed Interest Rate Home Loans Anz

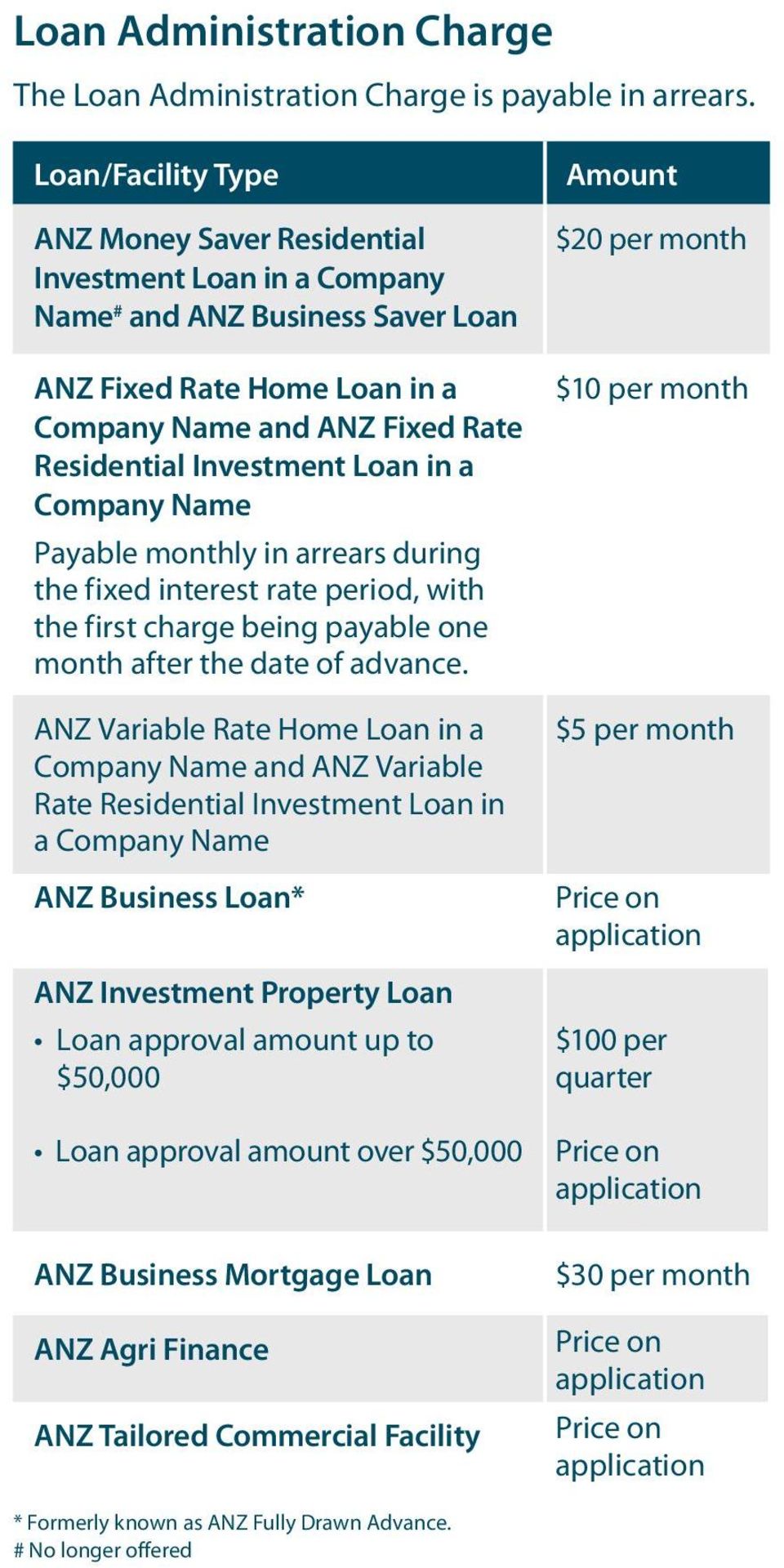

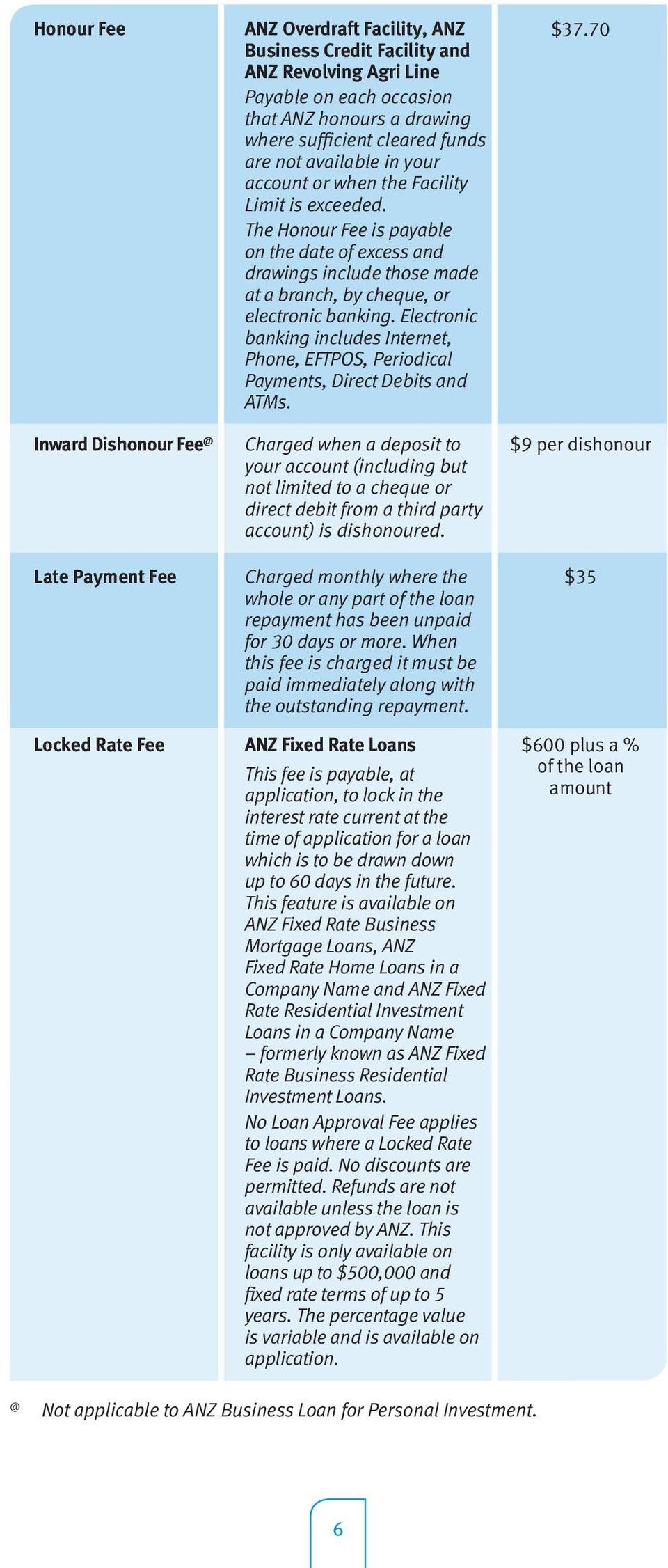

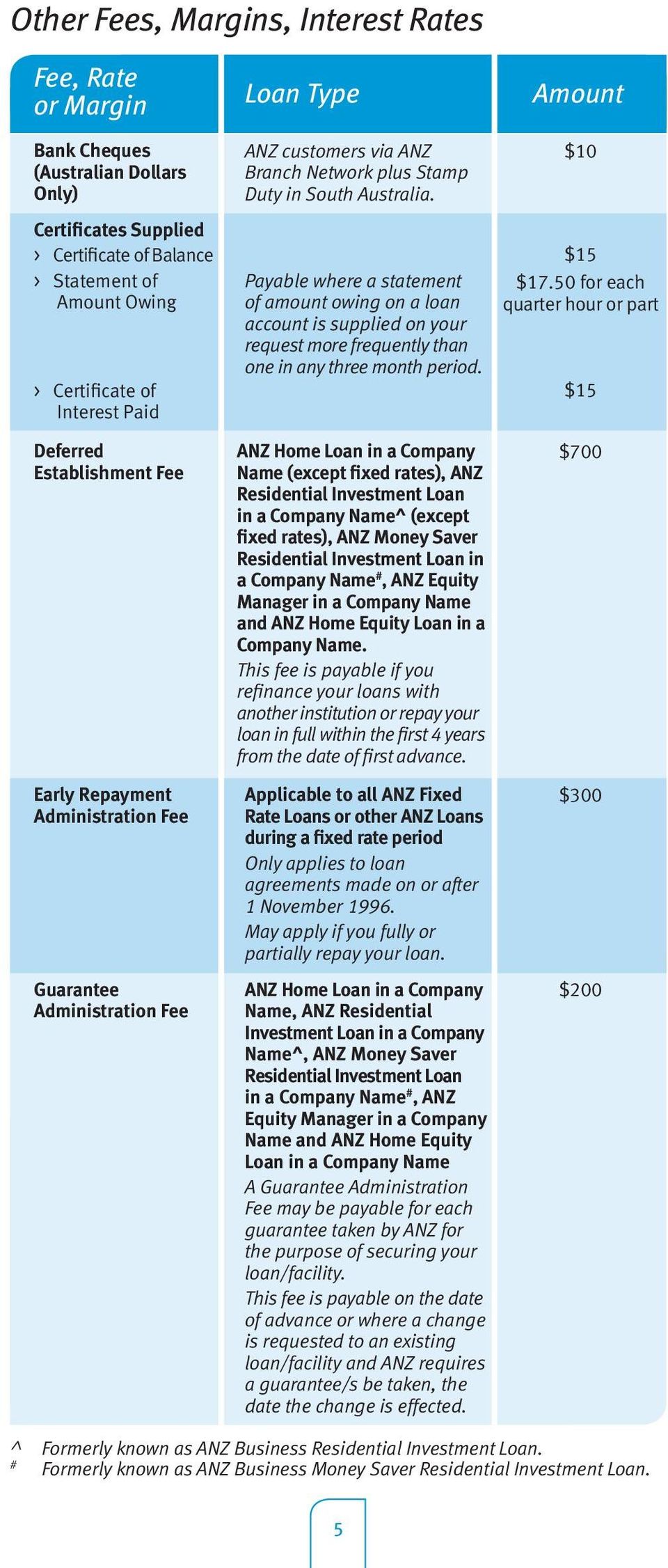

Finance Fees And Charges Anz Business Banking Pdf Free

Finance Fees And Charges Anz Business Banking Pdf Free

Finance Fees And Charges Anz Business Banking Pdf Free

Finance Fees And Charges Anz Business Banking Pdf Free

Finance Fees And Charges Anz Business Banking Pdf Free

Finance Fees And Charges Anz Business Banking Pdf Free

Fixed Interest Rate Home Loans Anz

Fixed Interest Rate Home Loans Anz

Finance Fees And Charges Pdf Free Download

Finance Fees And Charges Pdf Free Download

Finance Fees And Charges Pdf Free Download

Finance Fees And Charges Pdf Free Download

Anz Fixed Home Loan 3 75 Fixed Interest Rate For 2 Years

Anz Fixed Home Loan 3 75 Fixed Interest Rate For 2 Years