When you take a social fund loan you have to agree to repay they like you to repay your crisis and budgeting loans within 104 week and generally ask for 5 of your benefits but it is possible to reduce the amount that you repay to the social fund by formally asking them to look at the level of your repayments and showing that you can no longer afford to repay you loan at the rate agreed. These agreements are informal and can be worked out between you and your credit provider.

6 Steps To Repaying Your Student Loan

can i lower my budgeting loan repayments

can i lower my budgeting loan repayments is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i lower my budgeting loan repayments content depends on the source site. We hope you do not use it for commercial purposes.

A budgeting loan is interest free so you only pay back what you borrow.

Can i lower my budgeting loan repayments. There are ways to reduce the burden if you are unable to make the repayments at the original rate eg. Posted on august 11 2015 by kate b. Dwp takes up to 4 weeks to decide whether to reduce loan repayments for people in hardship.

If you choose to take out a debt consolidation loan be sure of the debt management plan youre getting into. Are you having difficulty making the repayments. If you already owe money to the social fund from a previous loan you may get another 1 but we will consider as part of your circumstances the budgeting loan debt you already have and if you can.

What can i use a budgeting loan for. If you cant repay an unsecured personal loan in full you should be allowed to make extra payments to help pay off the loan sooner and so reduce the overall cost. The repayments will be taken automatically from your benefits.

With unsecured loans taken out after 1 february 2011 you can make extra payments of up to 8000 in a 12 month period without penalty. This page tells you how budgeting loans work and how to apply for them including information about budgeting advances if youre on universal credit. I also receive housing benefit and council tax benefit which cover my rent and council tax.

The amount you repay is based on your income including any. Budgeting your debt consolidation repayments ensures that they will remain manageable over the term of the loan. Contact your nearest jobcentre plus office or the pension service for further advice.

Can i lower my budgeting loan repayments. If youre already getting certain benefits and need a loan see if you can apply for an interest free budgeting loan from the social fundthis can be much cheaper than paying high interest charges for borrowing from payday or doorstep lenders. Extending the repayment period.

Page 24 of the budgeting loan guide when discussing reviews of budgeting loan determinations says that. I have recently applied for a budgeting loan of 600 which i understood would have to be paid back within a maximum of 104wks which i calculated at approx 6 per week which i could just about afford to go without. Although you will still have to repay the same amount you will have longer to do so meaning that your monthly repayments will be lower.

This review process does not apply to. Paying off your loan early with extra payments. When applying you must declare the reason for borrowing the money.

Pay Off Your Debts Schemes That Help You Get Out Of Debt

6 Steps To Repaying Your Student Loan

Having Trouble With Debts In Singapore Here Is Your Roadmap To

6 Steps To Repaying Your Student Loan

6 Steps To Repaying Your Student Loan

8 Most Common Reasons Malaysians Get Low Credit Score Imoney

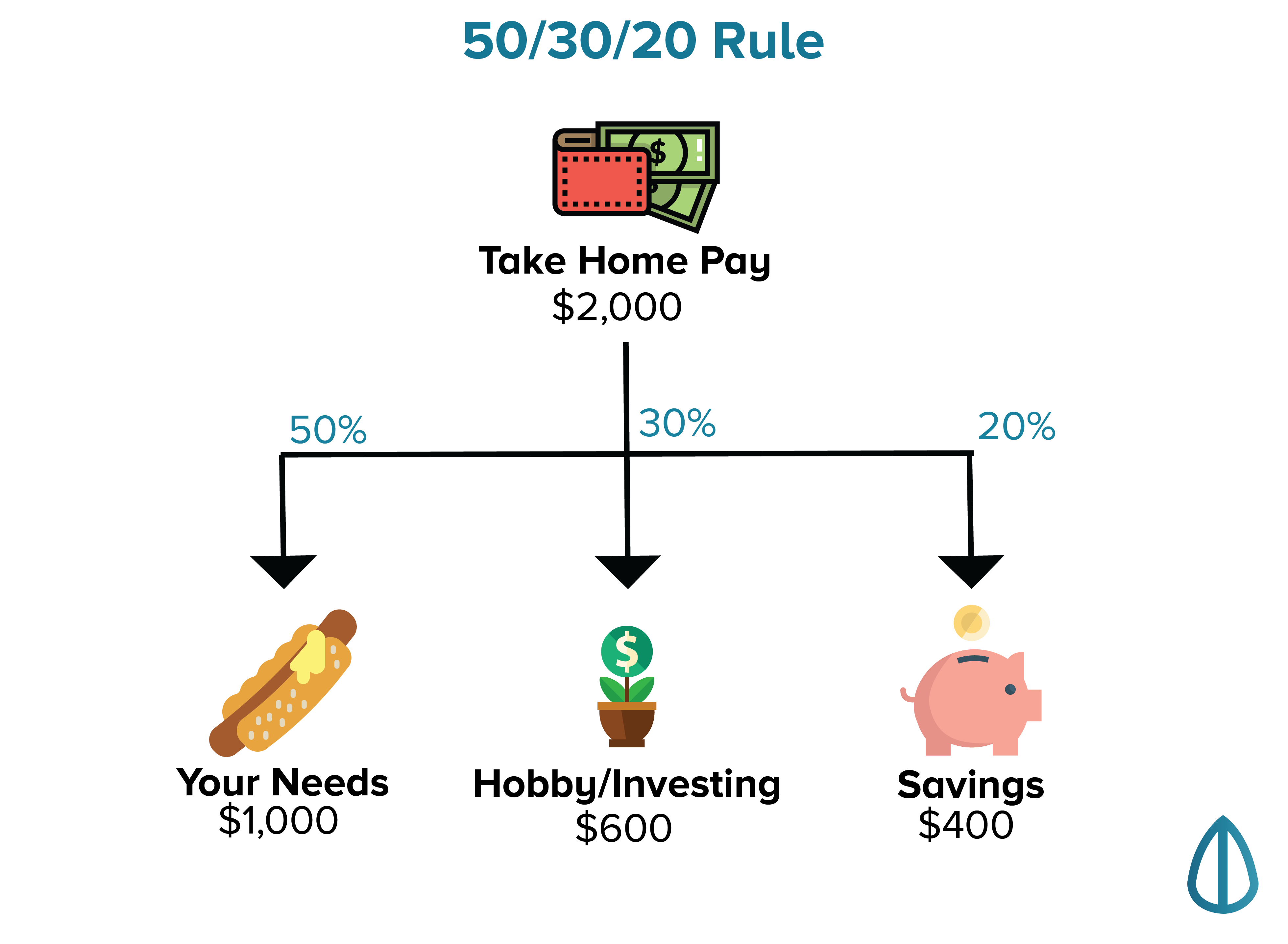

The 50 30 20 Budgeting Rule How It Works

Types Of Term Loan Payment Schedules Ag Decision Maker

5 Steps To Refinancing A Personal Loan Debt Management Now Finance