Private student loans are not subject to social security garnishment called offsets these social security repayments increased more for americans 50 and older than for younger borrowers. He went to a very expensive school that required him to take out a number of private and federal loans.

Can Social Security Be Garnished For Student Loans 100 Yes

Can Social Security Be Garnished For Student Loans 100 Yes

can private student loans garnish social security

can private student loans garnish social security is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can private student loans garnish social security content depends on the source site. We hope you do not use it for commercial purposes.

The federal government can garnish 15 of your social security benefits if you default on a federal student loan.

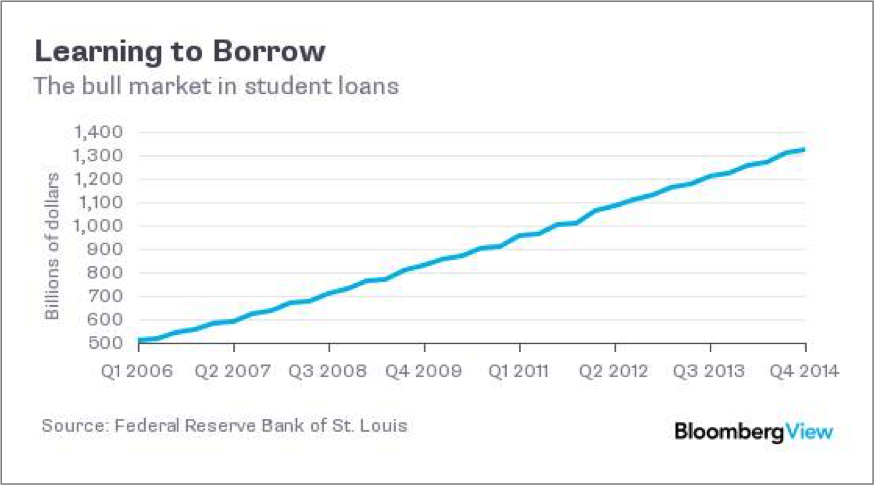

Can private student loans garnish social security. Those debts include federal taxes federal student loans child support and alimony victim restitution and other federal debts. There are certain debts however that social security can be garnished to pay for. Between 2002 and 2015 offsets jumped 407 percent among 50 to 64 year olds and 540 percent for those 65 and older.

Can social security be garnished for student loans. The government can shave. Dear kim six years ago i co signed for my grandsons student loans.

The good news is a private student loan lender or servicer cannot garnish your social security. Unfortunately social security payments can be garnished if you default on federal student loans as many retired borrowers find out the hard waycalled an offset more people than ever are losing out on social security benefits due to federal student loan debt. Private student loan lenders can garnish wages after winning a judgment against the debtor but they dont have the ability to garnish federal benefits like a federal student loan lender.

If you owe federal taxes 15 percent of your social security check can be used to pay your debt no matter how much money is left. Last year 156000 americans had their social security checks garnished because of student loans they had defaulted on. There is much information on the internet scaring seniors about this practice but very little information discussing how a garnishment of social security for taxes or student loans can be prevented or stopped.

Its tripled in number from 47500 in 2006 before the great recession. They cannot however garnish your pension or other retirement money. The feds can garnish social security to.

Treasury can garnish your social security benefits for unpaid debts such as back taxes child or spousal support or a federal student loan thats in default. Determined that there is no statute of limitations on social security offsets to repay student loans. They can also garnish your wages and offset your tax refund.

The irs and public student loan lenders can and occasionally will garnish 15 of a seniors social security income.

Can Social Security Be Garnished For Student Loans 100 Yes

Can Social Security Be Garnished For Student Loans 100 Yes

Can My Social Security Be Garnished For My Grandson S Student

Can My Social Security Be Garnished For My Grandson S Student

Social Security Checks Are Being Reduced For Unpaid Student Debt Wsj

Social Security Checks Are Being Reduced For Unpaid Student Debt Wsj

Social Security Income Can Be Garnished Due To Student Loan Debt

Social Security Income Can Be Garnished Due To Student Loan Debt

Private Student Loans Everything You Need To Know

Private Student Loans Everything You Need To Know

Can My Social Security Be Garnished For My Grandson S Student

Can My Social Security Be Garnished For My Grandson S Student

Social Security Garnished For Student Loans Student Loan Planner

Social Security Garnished For Student Loans Student Loan Planner

:max_bytes(150000):strip_icc()/GettyImages-1153451023-d311247b6eba44cfbcbf4e01e897f57e.jpg) Student Loan Creditors Can Garnish Your Money

Student Loan Creditors Can Garnish Your Money

More Borrowers Are Losing Social Security Benefits Over Old

More Borrowers Are Losing Social Security Benefits Over Old

Can You Stop Student Loan Wage Garnishment Sofi

Can You Stop Student Loan Wage Garnishment Sofi