If you surrender your policy or your policy lapses the loan plus. Interest is an amount you pay for the use of borrowed money.

/Borrowing-money-from-a-life-insurance-policy-57afcb4d5f9b58b5c248b3c6.jpg) Borrowing From A Life Insurance Policy

Borrowing From A Life Insurance Policy

can you deduct interest paid on life insurance loan

can you deduct interest paid on life insurance loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you deduct interest paid on life insurance loan content depends on the source site. We hope you do not use it for commercial purposes.

Therefore you would not get a deduction for the related interest.

Can you deduct interest paid on life insurance loan. A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy. You can take this deduction whether you deduct your car expenses using the actual expense method or the standard mileage rate because the standard mileage rate was not intended to encompass interest on a car loan. But before you take a life insurance loan consider the dangers ahead should you neglect to pay the interest on your loan or worse trust that the dividends from your variable universal life.

No that would be a personal expensethe loan was not taxable to you when you received it neither are life insurance proceeds. If you could deduct the interest on the equity loan also then you would be double dipping and the irs doesnt like that. I used the proceeds from a whole life insurance policy loan to invest in real estate.

For more information see publication 17 your. To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction. For example when you borrow from a bank you have monthly payments to make over a fixed term whereas if you borrow from your life insurance policy you can pay back as little or as much as you want at any time interval.

If the points you paid meet a nine point test of eligibility you can fully deduct points in the year you paid them. Deduction allowed in year paid. Borrowing from your life insurance policy allows a lot more flexibility in repayment.

The policy was paid up and cashed in and the cash surrender value was reduced by the accrued interest on the loan. There is a good reason to repay the loan if you can. If you use your car for business you can deduct the interest that you pay on your car loan as an interest expense.

The irs uses two categories to determine how much of your points payments you can deduct. In every situation one party can and the other party can deduct the interest. Some interest can be claimed as a deduction or as a credit.

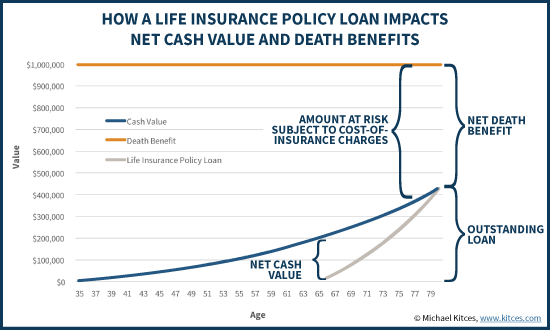

You can deduct points along with interest but not necessarily all at once. If the loan is not paid back before death the insurance company will reduce the face amount of the insurance policy when the claim is paid. Since the proceeds of the loan were used for investment is the interest deductible as investmen.

Tax Benefit Is Your Single Premium Life Insurance Policy Eligible

Tax Benefit Is Your Single Premium Life Insurance Policy Eligible

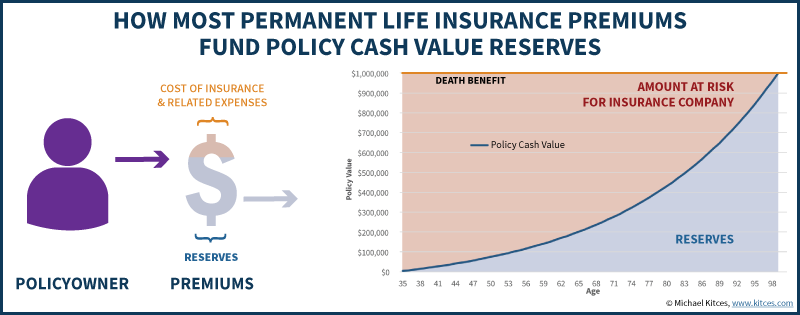

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

:max_bytes(150000):strip_icc()/a-senior-couple-fishing-on-a-lake-at-sunset--1091736878-8be8eebb9f6a48bda1d8fa2f4f25fb8d.jpg) What Are The Tax Implications Of A Life Insurance Policy Loan

What Are The Tax Implications Of A Life Insurance Policy Loan

Is Life Insurance Tax Deductible Northwestern Mutual

Is Life Insurance Tax Deductible Northwestern Mutual

Collateral Life Insurance Repsource Manulife Financial

Collateral Life Insurance Repsource Manulife Financial

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

Tips To Use All The Tax Benefits That Are Available On Home

Tips To Use All The Tax Benefits That Are Available On Home

Am I Eligible For Deduction On Home Loan Interest Paid While

Am I Eligible For Deduction On Home Loan Interest Paid While

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Loan Against Life Insurance Should You Opt For A Loan Against

Loan Against Life Insurance Should You Opt For A Loan Against