Refinancing is a convenient way to tackle an upside down loan and if you think this option is right for you learn more about an auto refinance with roadloans. If you owe money on your old car the dealer will often offer to roll that negative equity amount into the loan for a new car.

Help Me Sell My Car When I Am Upside Down On The Loan

Help Me Sell My Car When I Am Upside Down On The Loan

can you roll over a car loan

can you roll over a car loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you roll over a car loan content depends on the source site. We hope you do not use it for commercial purposes.

They will then give you 9000 on your trade in so that you can pay off your car.

Can you roll over a car loan. The price you pay for a used car also affects your loan to value ratio. You cannot roll over your old loans negative equity. Is there a way to roll over the debt from my last car into a new loan.

The dealer where you are buying the truck will raise the price of the truck by 3000. You cant get personal loans by having a dealer overcharge for a new car. First rolling over your auto loan balance doesnt eliminate negative equity you still have to pay for the old loan on top of the new one.

If you want a new car but still have an outstanding balance on your old car that exceeds the trade value of that car your dealer might be able to cover the difference negative equity in your new loan or lease as long as the amount is not too great relative to the financed cost of the new vehicle. If you purchase a 15000 vehicle with an 18000 lending value you might be able to roll over 3000 in negative equity to your new loan if you secured a loan with a 100 percent loan to value ratio. The extra 30000 for the car turns into 77710 over the 25 year term.

Explore auto refinancing with roadloans. This can be done. A longer loan to keep payments down is enticing but the shorter you can keep it the sooner you can get to positive equity.

For example if you financed a car for 26000 with no down payments and you managed to get a low interest rate of 3 with financing for 48 months you might be looking at payments of about 575 per month. Options for an underwater car loan. The only thing that you have to be wary of is that most banks will not go over 120 of the value of the car that you are buying.

As you continue to not pay off car loan balances and roll them into new loans you can find yourself thousands of dollars in debt over the amount a car is worth. Low interest rates on home loans make it appealing to roll a car loan into the mortgage but if youre not careful. I suggest you shop for a late model 2004 2005 used car with less than 40000 miles for under 10000 and shorten the new loan to four years instead of five if you can afford the payments.

For other people reading your question an explanation. At the same time if you want to roll over the negative equity and the lender allows it you need to be aware of a few things. When you are upside down on your loan.

Not only does that create more debt it is impossible to recoup the cost of those options when you resell the car.

Upside Down Car Loans Trading In Car With Loan Debt

Upside Down Car Loans Trading In Car With Loan Debt

How To Transfer A Car Loan To Another Person

How To Transfer A Car Loan To Another Person

Can You Transfer A Car Loan To Someone Else Car Loans Car Loan

Can You Transfer A Car Loan To Someone Else Car Loans Car Loan

Know Smart Tips To Transfer Car Loan To Other Person At Letzbank

Know Smart Tips To Transfer Car Loan To Other Person At Letzbank

Should I Roll Over My Old Car Loan If I Have Bad Credit In

Should I Roll Over My Old Car Loan If I Have Bad Credit In

Faq On Selling Your Car Otua Auto Connecting You To Buyers

Faq On Selling Your Car Otua Auto Connecting You To Buyers

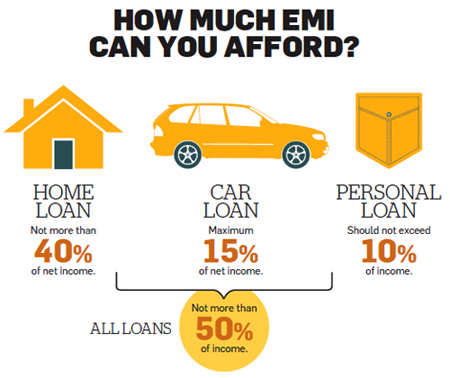

Ten Golden Rules To Follow When Taking A Loan The Economic Times

Ten Golden Rules To Follow When Taking A Loan The Economic Times

:brightness(10):contrast(5):no_upscale()/Getty-car-keys-on-dollars-PhotoAlto-Odilon-Dimier-153349389-56a2f1693df78cf7727b41e3.jpg) Should I Roll My Current Car Loan Into My New One

Should I Roll My Current Car Loan Into My New One

Lta Singpass Vehicle Transfer And Deregistration A Step By Step

Lta Singpass Vehicle Transfer And Deregistration A Step By Step

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqfk8rlx 9puvl3ai5wxakymda1j6iv0vndzxgb 3hakigcebfh

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqfk8rlx 9puvl3ai5wxakymda1j6iv0vndzxgb 3hakigcebfh